There are 4 basic things that a borrower needs to show a lender in order to get approved for a mortgage. Each category has so many what ifs and sub plots that each box can read as it’s own novel. In other words, each category has so many variables that can affect what it takes to get approved, but without further adieu here are the four categories in no particular order as each without any of these items, you’re pretty much dead in the water:

1. Income

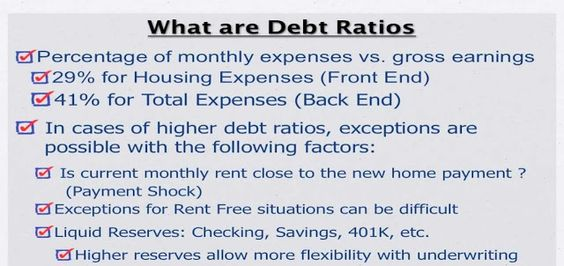

You need income. You need to be able to afford the home. But what is acceptable income? Let’s just say that there are two ratios mortgage underwriters look at to qualify you for mortgage payment:

First Ratio – The first ratio, top ratio or housing ratio. Basically that means out of all the gross monthly income you make, that no more that X percent of it can go to your housing payment. The housing payment consists of Principle, Interest, Taxes and Insurance. Whether you escrow or not every one of these items are factored into your ratio. There are a lot of exceptions to how high you can go, but let’s just say that if your ratio is 33% or less, generally, across the board, you’re safe.

Second Ratio- The second ratio, bottom ratio or debt ratio includes the housing payment, but also adds all of the monthly debts that the borrower has. So, it includes housing payment as well as every other debt that a borrower may have. This would include, Auto loans, credit cards, student loans, personal loans, child support, alimony….basically any consistent outgoing debt that you’re paying on. Again, if you’re paying less than 45% of your gross monthly income to all of the debts, plus your proposed housing payment, then……generally, you’re safe. You can go a lot higher in this area, but there are a lot of caveats when increasing your back ratio.

What qualifies as income? Basically, it’s income that has at least a proven, two year history of being received and pretty high assurances that the income is likely to continue for at least three years. What’s not acceptable? Unverifiable cash income, short term income and income that’s not likely to continue like unemployment income, student loan aid, VA education benefits,or short term disability are not allowed for a mortgage loan.

2. Assets

What the mortgage underwriter is looking for here is how much can you put down and secondly, how much will you have in reserves after the loan is made to help offset any financial emergencies in the future.

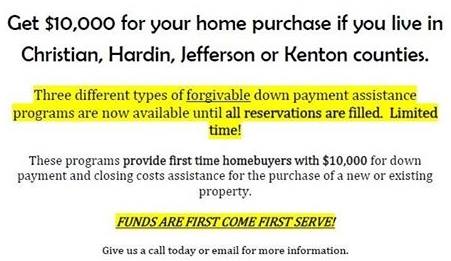

Do you have enough assets to put the money forth to qualify for the down payment that the particular program asks for. The only 100% financing or no money down loans still available in Kentucky for home buyers are available through USDA, VA, and KHC or Kentucky Housing Loans. Most other home buyers that don’t qualify for the no money down home loans mentioned above, will turn to the FHA program. FHA loans currently requires a 3.5% down payment.

Kentucky Home buyers that have access to putting down at least 5% or more, will usually turn to Fannie Mae or Freddie Mac mortgage programs so they can get better pricing when it comes to mortgage insurance.

These assets need to be validated through bank accounts, 401k or retirements account and sometimes gifts from relatives or employer.. Can you borrower the down payment? Sometimes. Generally if you’re borrowing a secured loan against a secured asset you can use that. But rarely can cash be used as an asset. FHA will allow for gifts from relatives for down payments with little as 3.5% down but Fannie Mae will require a 20% down payment when a gift is being used for the down payment on the home.

The down payment scenarios listed above are for Kentucky Primary Residences only. There are stricter down payment requirements for investment homes made in Kentucky.

3. Credit

620 is the bottom score (again with few exceptions) that lenders will permit. Below a 620, then you’re in a world of hurt. Even at 620, people consider you a higher risk that other folks and are going to penalize you or your borrower with a more expensive loan. 720 is when you really start to get in the “as a lender we love you” credit score. 740 is even better. Watch your credit scores carefully. You have three credit scores and the lender will take your middle score.

Kentucky FHA Mortgage Loans currently requires 3 years removal from a foreclosure or short sale and 2 years on a bankruptcy with good reestablished credit.

Kentucky Fannie Mae Mortgage Loans currently requires 4 years removal from a bankruptcy, and 7 years on a foreclosure.

Kentucky VA Mortgage Loans currently requires 2 years removal from a bankruptcy or foreclosure with good reestablished credit.

Kentucky USDA loans require 3 years removal from bankruptcy and foreclosure with good reestablished credit.

4. Appraisal

Generally, there’s nothing you can do to affect this. Bottom line here is…..”is the value of the house at least the value of what you’re paying for it?” If not, then not good things start to happen. Generally you’ll find less issues with values on purchase transactions, because, in theory, the realtor has done an accurate job of valuing the house prior to taking the listing. The big issue comes in refinancing. In purchase transactions, the value is determined as the

Lower of the value or the contract price!!!

That means that if you buy a $1,000,000 home for $100,000, the value is established at $100,000. Conversely, if you buy a $200,000 home and the value comes in at $180,000 during the appraisal, then the value is established at $180,000. Big issues….Talk to your loan officer.

For each one of these boxes, there are over 1,000 things that can effect if a borrower has reached the threshold to complete that box. Soooooooooooo…..talk to a great loan officer. There are so many loan officers that don’t know what they’re doing. But, conversely, there’s a lot of great ones as well. Your loan is so important! Get a great lender so that you know, for sure, that the loan you want, can be closed on!

5 popular programs that Kentucky Home buyers use to purchase their first home.

• Closing costs will vary on which rate you choose and the lender. Typically the higher the rate, the lesser closing costs due to the lender giving you a lender credit back at closing for over par pricing. Also, called a no-closing costs option. You have to weigh the pros and cons to see if it makes sense to forgo the lower rate and lower monthly payment for the higher rate and less closing costs.

Fico scores needed start at 620, but most conventional lenders will want a higher score to qualify for the 3-5% minimum down payment requirements Most buyers using this loan have high credit scores (over 720) and at least 5% down.

The rates are a little higher compared to FHA, VA, or USDA loan but the mortgage insurance is not for life of loan and can be rolled off when you reach 80% equity position in home.

Conventional loans require 4-7 years removed from Bankruptcy and foreclosure.

Max Conventional loan limits are set at $424,00 for 2017 in Kentucky

If you meet income eligibility requirements and are looking to settle in a rural area, you might qualify for the

KY USDA Rural Housing program. The program guarantees qualifying loans, reducing lenders’ risk and encouraging them to offer buyers 100% loans. That means Kentucky home buyers don’t have to put any money down, and even the “upfront fee” (a closing cost for this type of loan) can be rolled into the financing.

Fico scores usually wanted for this program center around 620 range, with most lenders wanting a 640 score so they can obtain an automated approval through GUS. GUS stands for the Guaranteed Underwriting system, and it will dictate your max loan pre-approval based on your income, credit scores, debt to income ratio and assets.

They also allow for a manual underwrite, which states that the max house payment ratios are set at 29% and 41% respectively of your income.

They loan requires no down payment, and the current mortgage insurance is 1% upfront, called a funding fee, and .35% annually for the monthly mi payment. Since they recently reduced their mi requirements, USDA is one of the best options out there for home buyers looking to buy in an rural area.

A rural area typically will be any area outside the major cities of Louisville, Lexington, Paducah, Bowling Green, Richmond, Frankfort, and parts of Northern Kentucky .

There is a map link below to see the qualifying areas.

There is also a max household income limits with most cutoff starting at $76,000 for a family of four, and up to $98,000 for a family of five or more.

USDA requires 3 years removed from bankruptcy and foreclosure.

There is no max USDA loan limit.

FHA loans are good for home buyers with lower credit scores and no much down, or with down payment assistance grants. FHA will allow for grants, gifts, for their 3.5% minimum investment and will go down to a 580 credit score.

The current mortgage insurance requirements are kinda steep when compared to USDA, VA , but the rates are usually good so it can counteracts the high mi premiums. As I tell borrowers, you will not have the loan for 30 years, so don’t worry too much about the mi premiums.

THe mi premiums are for life of loan like USDA.

FHA requires 2 years removed from bankruptcy and 3 years removed from foreclosure.

Maximum FHA loan limits in Kentucky are set around $285,000 and below.

VA loans are for veterans and active duty military personnel. The loan requires no down payment and no monthly mi premiums, saving you on the monthly payment. It does have an funding fee like USDA, but it is higher starting at 2% for first time use, and 3% for second time use. The funding fee is financed into the loan, so it is not something you have to pay upfront outof pocket.

VA loans can be made anywhere, unlike the USDA restrictions, and there is no income household limit and the max loan is $417,000 in Kentucky

Most VA lenders I work with will want a 580 credit score.

VA requires 2 years removed from bankruptcy or foreclosure.

This type of loan is administered by KHC in the state of Kentucky. They typically have $4500 to $6000 down payment assistance year around, that is in the form of a second mortgage that you pay back over 10 years.

Sometimes they will come to market with other down payment assistance and lower market rates to benefit lower income households with not a lot of money for down payment.

KHC offers FHA, VA, USDA, and Conventional loans with their minimum credit scores being set at 620 for all programs. The conventional loan requirements at KHC requires 660 credit score.

The max debt to income ratios are set at 40% an 45% respectively.

∘ What kind of credit score do I need to qualify for different first time home buyer loans in Kentucky?

Answer. Most lenders will wants a middle credit score of 640 for KY First Time Home Buyers looking to go no money down. The two most used no money down home loans in Kentucky being USDA Rural Housing and KHC with their down payment assistance will want a 640 middle score on their programs.

If you have access to 3.5% down payment, you can go FHA and secure a 30 year fixed rate mortgage with some lenders with a 580 credit score. Even though FHA on paper says they will go down to 500 credit score with at least 10% down payment, you will find it hard to get the loan approved because lenders will create overlays to protect their interest and maintain a good standing with FHA and HUD.

Another popular no money down loan is VA. Most VA lenders will want a 620 middle credit score but like FHA, VA on paper says they will go down to a 500 score, but good luck finding a lender for that scenario.

A lot of times if your scores are in the high 500’s or low 600’s range, we can do a rapid rescore and get your scores improved within 30 days.

∘ Does it costs anything to get pre-approved for a mortgage loan?

Answer: Most lenders will not charge you a fee to get pre-approved, but some lenders may want you to pay for the credit report fee upfront. Typically costs for a tri-merge credit report for a single borrower runs about $50 or less. Maybe higher if more borrowers are included on the loan application.

∘ How long does it take to get approved for a mortgage loan in Kentucky?

Answer: Typically if you have all your income and asset documents together and submit to the lender, they typically can get you a pre-approval through the Automated Underwriting Systems within 24 hours. They will review credit, income and assets and run it through the different AUS (Automated Underwriting Systems) for the template for your loan pre-approval. Fannie Mae uses DU, or Desktop Underwriting, FHA and VA also use DU, and USDA uses a automated system called GUS. GUS stands for the Guaranteed Underwriting System.

If you get an Automated Approval, loan officers will use this for your pre-approval. If you have a bad credit history, high debt to income ratios, or lack of down payment, the AUS will sometimes refer the loan to a manual underwrite, which could result in a longer turn time for your loan pre-approval answer

∘ Are there any special programs in Kentucky that help with down payment or no money down loans for KY First Time Home Buyers?

Answer: There are some programs available to KY First Time Home Buyers that offer zero down financing: KHC, USDA, VA, Fannie Mae Home Possible and HomePath, HUD $100 down and City Grants are all available to Kentucky First Time Home buyers if you qualify for them. Ask your loan officer about these programs

∘ When can I lock in my interest rate to protect it from going up when I buy my first home?

Answer: You typically can lock in your mortgage rate and protect it from going up once you have a home picked-out and under contract. You can usually lock in your mortgage rate for free for 90 days, and if you need more time, you can extend the lock in rate for a fee to the lender in case the home buying process is taking a longer time. The longer the term you lock the rate in the future, the higher the costs because the lender is taking a risk on rates in the future.

Interest rates are kinda like gas prices, they change daily, and the general trend is that they have been going up since the Presidential election in November 2016.

∘ How much money do I need to pay to close the loan?

Answer: Depending on which loan program you choose, the outlay to close the loan can vary. Typically you will need to budget for the following to buy a home: Good faith deposit, usually less than $500 which holds the home for you while you close the loan. You get this back at closing; Appraisal fee is required to be paid to lender before closing. Typical costs run around $400-$450 for an appraisal fee; home inspection fees. Even though the lender’s programs don’t require a home inspection, a lot of buyers do get one done. The costs for a home inspection runs around $300-$400. Lastly, termite report. They are very cheap, usually $50 or less, and VA requires one on their loan programs. FHA, KHC, USDAS, Fannie Mae does not require a termite report, but most borrowers get one done.

There are also lender costs for title insurance, title exam, closing fee, and underwriting fees that will be incurred at closing too. You can negotiated the seller to pay for these fees in the contract, or sometimes the lender can pay for this with a lender credit.

The lender has to issue a breakdown of the fees you will incur on your loan pre-approval.

How long is my pre-approval good for on a Kentucky Mortgage Loan?

Answer: Most lenders will honor your loan pre-approval for 60 days. After that, they will have to re-run your credit report and ask for updated pay stubs, bank statements, to make sure your credit quality and income and assets has not changed from the initial loan pre-approval.

How much money do I have to make to qualify for a mortgage loan in Kentucky?

Answer: The general rule for most FHA, VA, KHC, USDA and Fannie MAe loans is that we run your loan application through the Automated Underwriting systems, and it will tell us your max loan qualifying ratios.

There are two ratios that matter when you qualify for a mortgage loan. The front-end ratio, is the new house payment divided by your gross monthly income. The back-end ratio, is the new house payment added to your current monthly bills on the credit report, to include child support obligations and 401k loans.

Car insurance, cell phone bills, utilities bills does not factor into your qualifying rations.

If the loan gets a refer on the initial desktop underwriting findings, then most programs will default to a front end ratio of 31% and a back-end ratio of 43% for most government agency loans that get a refer. You then take the lowest payment to qualify based on the front-end and back-end ratio.

So for example, let’s say you make $3000 a month and you have $400 in monthly bills you pay on the credit report. What would be your maximum qualifying house payment for a new loan?

Take the $3000 x .43%= $1290 maximum back-end ratio house payment. So take the $1290-$400= $890 max house payment you qualify for on the back-end ratio.

Then take the $3000 x .31%=$930 maximum qualifying house payment on front-end ratio.

So now your know! The max house payment you would qualify would be the $890, because it is the lowest payment of the two ratios.

Customer Testimonials

We just moved here the first of January in 2017 from Ohio to the Louisville, KY area and we found Joel’s website online. He was quick to respond to us and got back the same day on our loan approval. He was very knowledgeable about the local market and kept us up-to date throughout the loan process and was a pleasure to meet at closing. Would recommend his services.

Angela Forsythe

“We were searching online for mortgage companies in Louisville, Ky locally to deal with and found Joel’s website, and it was a godsend. He was great to work with, and delivered on everything he said he would do. I ended up referring my co-worker at UPS, and she was very pleased with his service and rates too. Would definitely vouch for him.” September 2016

Monica Leinhardt

“We contacted Joel back in July 2011 to refinance our Mortgage and he was great to work with. We contacted several lenders locally and online, and most where taking almost 60 days to close a refinance, Joel got it done in 23 days start to finish,I would definetly recommmend him. He got us 3.75% with just $900 in closing costs on our FHA Streamline loan.Kayle Griffin

“Joel is one of the best Mortgage Brokers I have ever worked with in my sixteen years in the real estate and mortgage business.” May 25, 2010

Tim Beck

“Joel has always worked very hard to keep his word and to work out seasonable solutions to difficult problems. He is truly an expert in FHA and other type loans.” September 1, 2010

Nancy Nalley

“I have worked with Joel since 1998. He is a great loan professional.” I refer most of my Louisville, Kentucky area home buyers to him and he always take special care of them. August 23, 2012

Jon ClarK

“Joel Lobb is a real professional in the lending industry, with many years of experience, he is the one to go to for any mortgage lending needs.” August 22, 2011

RICHARD VOLZ , Residential Sales , Remax Foursquare Realty

“When looking to purchase our new home in 2006, I had the pleasure of meeting Joel Lobb. Not only was he personable and easy to reach, he was extremely knowledgable in his field and made sure to find us the best rate and a top notch mortgage company. We were able to complete the process in less than 3 weeks with his expertise. I find Joel to have the utmost high integrity and I recommend him to anyone who say’s they are need of mortgage assistance. He is also fantastic and keeping everyone up to date on the latest in the housing industry through his twitter posts. He provided great results for our family and we still communicate to this day!” August 21, 2010

Stacie Drake

“We first use Joel on our new home purchase in 2007 in St Matthews, Kentucky area and he was great to work with. We have since refinanced our home with him in 2010 when rates got really low and he has always delivered on what he says. I could not imagine using anyone else.”

Melody Glasscock March 2014

Absolutely Amazing!! I emailed Joel after I had just got a denial from a bank and just thought i would try to get some advice on what my next steps would be to get a house. I honestly didn’t expect to even get a reply because my credit is not great. That was about a week and a half ago. I just signed a contract on a house last night. ONLY because of Joel Lobb. He even worked with us throughout the weekend, which shocked me. Best decision I have ever made. THANK YOU SO MUCH FOR WORKING WITH US THROUGHOUT THE ENTIRE PROCESS.

Cee Bell August 2017

Contacted him about buying a home and he was great to work with. I was moving to Louisville Ky to take a new job and he walked me through the entire process. He explained to me all the different options for FHA, VA, USDA mortgage loans and credit score requirements versus Fannie Mae. Since I was a first time home buyer I needed alot of help and guidance. I would definitely recommend him. Fast to respond and available to answer questions that I or my realtor had after hours.

Anderson Johnson June 2018

We moved from Michigan to Northern Kentucky area and we were really impressed. We got a USDA loan no money down and closed in less than 3.5 weeks. We shopped around online with other lenders but Joel was always first to respond and his rates were just a little better than other lenders. He kept us informed through the process along with our realtor and there was absolutely no surprises like we heard from other co-workers and friends that they experienced in their loan process. We have already referred another co-worker to Joel . He’s AWESOME!

I can answer your questions and usually get you pre-approved the same day.

Call or Text me at 502-905-3708 with your mortgage questions.

Email Kentuckyloan@gmail.com

Joel Lobb (NMLS#57916)

Senior Loan Officer

American Mortgage Solutions, Inc.

10602 Timberwood Circle Suite 3

Louisville, KY 40223

Company ID #1364 | MB73346

Text/call 502-905-3708

kentuckyloan@gmail.com

The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the view of my employer. Not all products or services mentioned on this site may fit all people.

, NMLS ID# 57916, (www.nmlsconsumeraccess.org). I lend in the following states: Kentucky