To determine if you can get approved for a Kentucky mortgage, several factors need to be considered, including your credit score, income, employment history, debt-to-income ratio, and down payment. Here’s a general overview of what lenders typically look for:

-

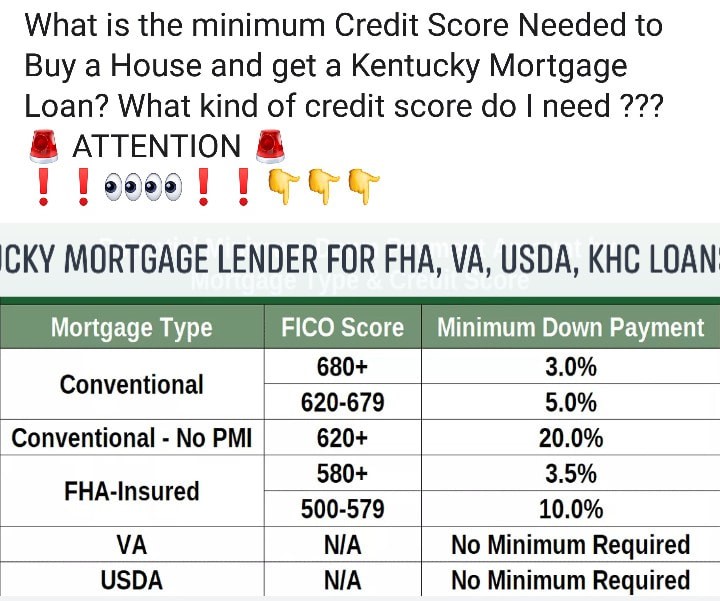

Credit Scores : Most Kentucky Mortgage lenders prefer a credit score of 620 or higher for conventional loans. FHA loans may accept lower credit scores, starting around 500, but a higher score (typically 580 or above) can improve your chances and offer better terms.

Here are the general credit score requirements for FHA, VA, USDA, and Fannie Mae mortgage loans in Kentucky:

Loan Program Minimum Credit Score Requirement Additional Notes FHA Loan 500 to 580 A credit score of 500 to 579 requires a 10% down payment; a score of 580 or higher requires a 3.5% down payment. VA Loan No minimum score VA lenders are more flexible with credit scores, but most lenders prefer a score of 620 or higher. USDA Loan no minimum score USDA lenders typically require a minimum credit score of 640 or higher. Fannie Mae Loan 620 or higher Fannie Mae loans generally require a credit score of 620 or higher. -

Income and Employment History: Lenders evaluate your income stability and 2 year employment history to ensure you have a reliable source of income to make mortgage payments. Consistent employment and sufficient income are crucial.

Here’s a chart outlining the employment and work history requirements for Kentucky FHA, VA, USDA, and Fannie Mae mortgage loans:

Loan Program Employment History Work History Guidelines Kentucky FHA Loan 2 years of consistent employment with steady income 2 years of stable employment, including gaps explained Employment can include salaried, self-employed, or contract positions. Gaps in employment may require explanations and documentation. Kentucky VA Loan Stable income with continuous employment Stable work history with no significant gaps VA loans focus on the stability of income rather than specific employment duration. Military service may fulfill employment requirements. Kentucky USDA Loan 2 years of stable employment with reliable income 2 years of continuous employment, including explanations for gaps USDA loans prioritize consistent income and employment history. Gaps may require explanations and additional documentation. Fannie Mae Loan 2 years of employment with steady income and job stability 2 years of stable employment, including explanations for gaps Fannie Mae loans emphasize a stable work history with a focus on income stability. Gaps in employment may need explanations and additional documentation. These guidelines provide an overview of the employment and work history requirements for FHA, VA, USDA, and Fannie Mae mortgage loans. Lenders may have specific criteria and may consider factors such as income stability, type of employment, gaps in employment, and documentation of income sources. Borrowers should consult with a mortgage professional or lender to understand the detailed employment and work history requirements for their loan application.

-

Debt-to-Income (DTI) Ratio: This ratio compares your monthly debt payments to your gross monthly income. Lenders typically prefer a DTI ratio of 31% to 45% on front end ratio and up to 55% on the back-end ratio, although some may accept higher ratios with compensating factors.

Here’s a chart comparing the debt ratio requirements forKentucky FHA, VA, USDA, and Fannie Mae mortgage loans:

Loan Program Front-End DTI Ratio Back-End DTI Ratio Guidelines Kentucky FHA Loan Up to 45% Up to 56.99% Front-end DTI includes housing-related expenses (mortgage, taxes, insurance). Back-end DTI includes all monthly debts. Kentucky VA Loan 41% or higher 41% or higher VA guidelines do not have specific DTI ratio limits but focus on residual income after accounting for housing and debt costs. Kentucky USDA Loan Up to 33% Up to 45% Front-end DTI includes housing expenses. Back-end DTI includes all monthly debts. Kentucky Fannie Mae Loan Up to 40% Up to 50% Front-end DTI includes housing expenses. Back-end DTI includes all monthly debts. -

Down Payment: The amount of your down payment can also impact your approval chances. A larger down payment can lower your loan-to-value ratio (LTV) and reduce the lender’s risk.

Here’s a down payment chart for Kentucky FHA, VA, USDA, and Fannie Mae mortgage loans:

Loan Program Minimum Down Payment Down Payment Source Kentucky FHA Loan 3.5% of purchase price Can be from personal savings or gift funds Kentucky VA Loan 0% (No down payment) N/A (VA loans offer 100% financing) Kentucky USDA Loan 0% (No down payment) N/A (USDA loans offer 100% financing) Kentucky Fannie Mae Loan

3% to 5% of purchase price Can be from personal savings or gift funds -

Other Factors: Lenders may also consider your savings and assets, existing debts, credit history, and the type of mortgage you’re applying for (e.g., FHA, VA, USDA, conventional).

To get a more accurate assessment of your mortgage approval chances, it’s best to consult with a mortgage lender or broker. They can review your financial situation, credit history, and specific loan requirements to determine your eligibility and help you navigate the mortgage approval process.

Joel Lobb Mortgage Loan Officer

American Mortgage Solutions, Inc.

10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the view of my employer. Not all products or services mentioned on this site may fit all people.

NMLS ID# 57916, (www.nmlsconsumeraccess.org).