Category: $100 Down FHA Mortgage

First-time home buyers in Kentucky. Joel Lobb

first-time home buyers in Kentucky. Joel Lobb

For first-time home buyers in Kentucky. Joel Lobb, a seasoned mortgage broker, has carved out a niche in assisting these individuals with a variety of loan options tailored to their unique needs. Here’s an overview of how Lobb is helping Kentuckians achieve their dream of owning a home.

### Joel Lobb: Facilitating Homeownership in the Bluegrass State

**A Diverse Range of Mortgage Options**

Joel Lobb specializes in a wide array of mortgage loans, including:

– **FHA Loans**: These loans are a great fit for buyers with lower credit scores or those who can afford only a minimal down payment.

– **VA Loans**: Tailored for veterans and active military members, offering favorable terms with little to no down payment.

– **USDA Loans**: Designed for rural home buyers, providing 100% financing options.

– **KHC Loans**: In collaboration with the Kentucky Housing Corporation, these loans come with down payment assistance, making them ideal for first-time buyers.

**Expert Guidance Through the Mortgage Process**

Lobb’s approach to mortgage lending is characterized by a personalized touch. He understands that purchasing a home is a significant milestone and offers his expertise to guide buyers through every step of the process. His services include:

– **Credit Counseling**: Assisting buyers in understanding and improving their credit scores to qualify for better loan terms.

– **Loan Comparison**: Helping clients compare different mortgage products to find the best match for their financial situation.

– **Pre-Approval Assistance**: Working with buyers to get pre-approved, which can make the home-buying process smoother and faster.

**Advantages Over Traditional Banking Institutions**

Unlike larger banks that may have a limited selection of mortgage products, Joel Lobb has the flexibility to broker loans through various mortgage companies. This allows him to offer:

– **Competitive Rates**: By shopping around, Lobb can find the most favorable interest rates and terms for his clients.

– **Customized Solutions**: He can address unique financial circumstances that may not fit into a traditional bank’s criteria.

**Commitment to First-Time Home Buyers**

Lobb’s dedication to first-time home buyers is evident in his commitment to making the process as accessible and understandable as possible. He provides:

– **Educational Resources**: Offering insights into the mortgage process, from understanding loan types to preparing for closing costs.

– **Community Involvement**: By assisting new homeowners, Lobb contributes to the economic growth and stability of communities across Kentucky.

**Conclusion**

For first-time home buyers in Kentucky, Joel Lobb offers a path to homeownership that is informed, personalized, and supportive. His expertise in various loan options and his dedication to client education make him a valuable resource for anyone looking to navigate the complexities of the mortgage landscape²³⁴.

—

This article is for informational purposes only and does not constitute financial advice. For personalized guidance, it’s recommended to consult directly with a mortgage professional like Joel Lobb.

Source: Conversation with Bing, 3/9/2024

(1) Joel Lobb, Mortgage Broker FHA, VA, KHC, USDA. https://www.mylouisvillekentuckymortgage.com/2010/10/get-approved-for-mortgage-or-home-loan.html.

(2) Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural …. https://www.mylouisvillekentuckymortgage.com/.

(3) First-time Home-buyers in Kentucky – Louisville Kentucky Mortgage …. https://www.mylouisvillekentuckymortgage.com/p/common-questions-from-first-time.html.

(4) . https://bing.com/search?q=Joel+Lobb+mortgage+broker+Kentucky+first+time+home+buyers.

(5) Joel Lobb – Louisville, Kentucky, Key Financial Mortgage, University of …. https://about.me/joel.lobb.

(6) Joel Lobb, Mortgage Broker FHA, VA, KHC, USDA. https://business.google.com/v/joel-lobb-mortgage-broker-fha-va-khc-usda/04361775572510182499/a2

Here are action steps you can take right now to buy a home in Kentucky in 2024

If you’re planning to buy a home in Kentucky in 2024, here are some essential steps to consider:

1. Focus on improving your credit score to qualify for a mortgage with a low interest rate.

2. Manage your debt-to-income ratio by repaying existing debt, increasing your income, or both.

3. Ensure timely payments on all accounts to maintain a good credit score.

4. Get pre-approved for a mortgage before searching for a home to know your affordability.

5. Keep credit card utilization below 30% and seek down payment assistance programs if needed.

Here are action steps you can take right now to buy a home in Kentucky in 2024

1. Focus on your credit score

FICO credit scores are among the most frequently used credit scores, and range from 350-800 (the higher, the better). A consumer with a credit score of 750 or higher is considered to have excellent credit, while a consumer with a credit score below 620 is considered to have poor credit.

To qualify for a mortgage and get a low mortgage rate, your credit score matters.

Each credit bureau collects information on your credit history and develops a credit score that lenders use to assess your riskiness as a borrower. If you find an error, you should report it to the credit bureau immediately so that it can be corrected.

2. Manage your debt-to-income ratio

Many lenders evaluate your debt-to-income ratio when making credit decisions, which could impact the interest rate you receive.

A debt-to-income ratio is your monthly debt payments as a percentage of your monthly income. Lenders focus on this ratio to determine whether you have enough excess cash to cover your living expenses plus your debt obligations.

Since a debt-to-income ratio has two components (debt and income), the best way to lower your debt-to-income ratio is to:

- repay existing debt;

- earn more income; or

- do both

3. Pay attention to your payments

Simply put, lenders want to lend to financially responsible borrowers.

Your payment history is one of the largest components of your credit score. To ensure on-time payments, set up autopay for all your accounts so the funds are directly debited each month.

FICO scores are weighted more heavily by recent payments so your future matters more than your past.

In particular, make sure to:

- Pay off the balance if you have a delinquent payment

- Don’t skip any payments

- Make all payments on time

4. Get pre-approved for a mortgage before you start shopping for a home loan.

Too many people find their home and then get a mortgage.

Switch it.

Get pre-approved with a lender first. Then, you’ll know how much home you can afford.

To get pre-approved, lenders will look at your income, assets, credit profile and employment, among other documents.

5. Keep credit utilization low on your credit cards

Lenders also evaluate your credit card utilization, or your monthly credit card spending as a percentage of your credit limit.

Ideally, your credit utilization should be less than 30%. If you can keep it less than 10%, even better.

For example, if you have a $10,000 credit limit on your credit card and spent $3,000 this month, your credit utilization is 30%.

Here are some ways to manage your credit card utilization:

- set up automatic balance alerts to monitor credit utilization

- ask your lender to raise your credit limit (this may involve a hard credit pull so check with your lender first)

- pay off your balance multiple times a month to reduce your credit utilization

6. Look for down payment assistance in Kentucky

There are various types of down payment assistance, even if you have student loans.

Here are a few:

- FHA loans – federal loan through the Federal Housing Authority

- USDA loans – zero down mortgages for rural and suburban homeowners

- VA loans – if military service

- Kentucky Housing Down Payment Assistance of $10,000

There are federal, state and local assistance programs as well so be on the look out.

If you want a personalized answer for your unique situation call, text, or email me or visit my website below:

Joel Lobb

Mortgage Loan Officer

Individual NMLS ID #57916

American Mortgage Solutions, Inc.

10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

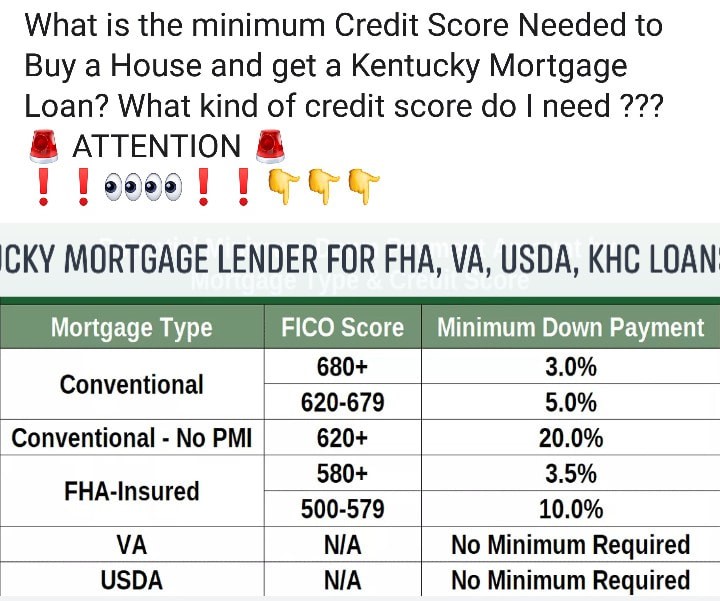

What is the minimum credit score I need to qualify for a Kentucky FHA, VA, USDA and KHC Conventional mortgage loan?

What is the minimum credit score I need to qualify for a Kentucky mortgage currently?

Question:

What is the current minimum credit scores needed to qualify for a Kentucky mortgage Loan?

Answer:

The minimum credit score needed to qualify for a Kentucky mortgage depends on the type of loan program you are looking to obtain, this could be the reason that you have received conflicting answers.

The most common types of mortgage are Conventional, FHA, USDA, VA, and KHC mortgage loans in Kentucky. I’ll explain each briefly below and the minimum credit score needed to qualify for each loan program. Keep in mind these are continuously changing and can vary by lender do to credit overlays.

Kentucky Conventional or Fannie Mae

Conventional loans make up the majority of mortgages in the US. They are also known as conforming loans, because they conform to specific guidelines set by Fannie Mae and Freddie Mac.

- Minimum Credit Score is 620

- What Are the Conforming Loan Limits for 2024?

Property Type Minimum Conforming Loan Limit Maximum Conforming Loan Limit

One-unit $766,550 $1,149,825

Two-unit $981,500 $1,472,250

Three-unit $1,186,350 $1,779,525

Four-unit $1,474,400 $2,211,600 - You can use a conventional loan to buy a primary residence, second home, or rental property

- Conventional loans are available in fixed rates, adjustable rates (ARMs), and offer many loan terms usually from 10 to 30 years

- Down payments as low as 3% and 5% depending on Home Ready or straight conventional loan.

- No monthly mortgage insurance with a down payment of at least 20%

- Max Debt to Income Ratio of 50%

KENTUCKY FHA MORTGAGE

An FHA loan is a mortgage issued by federally qualified lenders and insured by the Federal Housing Administration (FHA). FHA loans are designed for low-to-moderate income borrowers who are unable to make a large down payment.

- Minimum Credit Score is 500 with at least 10% down

- Minimum Credit Score is 580 if you put less than 10% down

- The maximum loan amount varies by Geographical Area, for 2024 is $498,257

- Upfront and Monthly Mortgage Insurance is required regardless of the Loan to Value

- FHA Loans are only available for financing primary residences

- Maximum Debt to Income Ratio of 50% (unless mitigating factors justify allowing a higher DTI) up to 57% in some instances with strong compensating factors.

KENTUCKY USDA RURAL HOUSING LOAN

-

- 100% Financing

- Cities and towns located outside metro areas-see link (https://eligibility.sc.egov.usda.gov/eligibility/welcomeAction.do?pageAction=sfp

- Do NOT have to be a Kentucky First Time Home Buyer

- No Down Payment

- 30 year low fixed rate loans

- No Prepayment Penalty

- Great Low FIXED Interest Rates

- No max loan limits, just income limits

- Possible to Roll Closing Costs into Loan if Appraises Higher

- No Cash Reserves Required

- UNLIMITED Seller Contribution toward Closing Costs

- 100% Gifted Closing Costs allowed

- Primary Residents only (no rentals/investment properties)

- Debt to income ratios no more than 45% with GUS approval and 29 and 41% with a manual underwrite.

- Only Need a 580 Credit Score to Apply*** Most USDA loans need a 620 or score higher to get approved through their automated underwriting system called GUS. 640 usually required for an automated approval upfront.

- No bankruptcies (Chapter 7) last 3 years and no foreclosure last 3 years. If Chapter 13 bankruptcy possible to go on after 1 year

-

KENTUCKY VA Mortgage

- 100% Financing Available up to qualifying income and entitlement

- Must be eligible veteran with Certificate of Eligibility. We can help get this for veterans or active duty personnel.

- No Down Payment Required

- Seller Can Pay ALL Your Closing Costs

- No Monthly Mortgage Insurance

- Minimum 580 typically Credit Score to Apply–VA does not have a minimum credit score but lenders will create credit overlays to protect their interest.

- Active Duty, Reserves, National Guard, & Retired Veterans Can Apply

- No bankruptcies or foreclosures in last 2 years and a clear CAVIRS

- Debt to income ratios vary, but usually 55% back-end ratio with a fico score over 620 will get it done on qualifying income and if it is a manual underwrite, 29% and 41% respectively

- Can use your VA loan guaranty more than once, and in some cases, can have two existing VA loans out at they same time. Call or email for more info on this scenario.

- Cost of VA loan appraisal in Kentucky now costs a minimum $605 with a termite report needed on all purchase and refinance transactions unless a condo.

- 2 year work history needed on VA loans unless you can show a legitimate excuse, ie. off work due to injury, schooling, education etc.

- You cannot use your GI Bill for income qualifying for the mortgage payment.

KENTUCKY HOUSING DOWN PAYMENT ASSISTANCE 100 FINANCING

Down Payment: There are still housing programs that exist for Kentucky home buyers whereas you can purchase a home with no down payment. You will need a 620 mid credit score to purchase a home using the KHC loan programs for their no down payment credit requirements.

How the Down Payment Assistance Program (DAP) Works

Down payment assistance loans are available up to $10,000 and is paid back over a period of ten years at a current rate of 3.75%.

Regular DAP

- Purchase price up to $481,176 with Secondary Market or Mortgage Revenue Bond (MRB) income limits.

- Assistance in the form of a loan up to $10,000 in $100 increments.

- Repayable over a 10-year term at 3.75 percent.

- Available to all KHC first-mortgage loan recipients

If you have questions about qualifying as first time home buyer in Kentucky, please call, text, email or fill out free prequalification below for your next mortgage loan pre-approval.

The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the views of my employer. Not all products or services mentioned on this site may fit all people

Kentucky FHA Loan Requirements for 2024

Originally posted on Kentucky FHA Mortgage Lender:

Kentucky FHA Loan Requirements The requirements for Kentucky FHA loans are set by HUD. Borrowers must have a steady employment history of the last two years within the same industry or line of work. Recent college graduates can use their transcripts to supplant the 2 year work history…

Kentucky FHA Loan Requirements for 2024 to include Credit Fico Scores, Down Payment, Income and Job history

FHA

An FHA loan is a mortgage issued by federally qualified lenders and insured by the Federal Housing Administration (FHA). FHA loans are designed for low-to-moderate income borrowers who are unable to make a large down payment.

- Minimum Credit Score is 500 with at least 10% down

- Minimum Credit Score is 580 if you put less than 10% down

FHA Guidelines

- Upfront and Monthly Mortgage Insurance is required regardless of the Loan to Value

- FHA Loans are only available for financing primary residences

- Maximum Debt to Income Ratio of 50% (unless mitigating factors justify allowing a higher DTI)

Kentucky FHA Loan Requirements

The requirements for Kentucky FHA loans are set by HUD.

- Borrowers must have a steady employment history of the last two years within the same industry or line of work. Recent college graduates can use their transcripts to supplant the 2-year work history rule as long as it makes sense.

- Self-Employed will need a 2-year history of tax returns filed with IRS. They will take a 2-year average.

- FHA requires a 3.5% down payment. Can be gifted from family member or from retirement savings plan, or money saved-up. Any type of cash deposits is not allowed for down payments. No exceptions to this rule!! This is one of the biggest issues I see in FHA underwriting nowadays.

- FHA loans are for primary residence occupancy. Not rental houses.

- Borrowers must have a property appraisal from a FHA-approved appraiser.

- Borrowers’ front-end ratio (mortgage payment plus HOA fees, property taxes, mortgage insurance, homeowners’ insurance) needs to be less than 31 percent of their gross income, typically. You may be able to get approved with as high a percentage as 43 percent. If the Automated Underwriting System gives you an Approved Eligible you can go higher on the debt ratios

- Borrowers must have a minimum credit score of 580 for maximum financing with a 3.5% down payment

- Borrowers must have a minimum credit score of 500-579 for maximum LTV of 90 percent with a minimum down payment of 10 percent. Most lenders will not go below 580 to 620 score, and very few lenders will go to 580 score. It’s best to work on getting your scores up before you apply or work with a loan officer to improve them.

- 2 years removed from Chapter 7 is required with good pay history after bankruptcy

- 1 year removed from Chapter 13 is okay with an excellent pay history with the Chapter 13 plan and permission from trustee. You will need to qualify with the Chapter 13 payment along with new house payment. Again, scores will play into your loan pre-approval.

- Typically, borrowers must be three years out of foreclosure and have re-established good credit. Exceptions can be made if there were extenuating circumstances and you’ve improved your credit. If you were unable to sell your home because you had to move to a new area, this does not qualify as an exception to the three-year foreclosure guideline.

FHA

Low Down Payment which can be 100% gift from family member or Grant Program

Seller can pay closing costs-Maximum 6% of purchase price

There is maximum mortgage amount for each county. Check FHA loan limit for your county.

Non-occupant co-signers are allowed on this program.

FHA Approved Condos-Single family home-2-4 unit properties, and PUDs are eligible.

Fast automated underwriting approval available. Also, the file can be manually underwritten by a live person to get loan approval if you do not receive approval through automated underwriting system.FHA Foreclosure Program

Must be HUD Owned property or FHA Foreclosure in HUD Participating Communities

$100 Down Payment than standard FHA program

580 minimum credit score

Single family, 1-4 unit properties, HUD approved condominiums, and PUDS eligible2. Kentucky Housing Corporation Down Payment Assistance for 2024.

Kentucky Down payment assistance loans are available up to $10,000 for Mortgage

KHC recognizes that down payments, closing costs, and prepaids are stumbling blocks for many potential home buyers. We offer a special loan program to help with those. Your KHC-approved lender can help you apply.

Eligibility: Both first-time and repeat home buyers purchasing a single-family dwelling. Purchase price can be no more than $481,176. Applicant’s income must be within applicable secondary market limits in effect. If KHC’s Homebuyer Tax Credit is used, then household income must be under the Homebuyer Tax Credit income limits.

Mortgage Revenue Bond (MRB) First Mortgage Products Eligibility: Must be a first-time home buyer, unless purchasing a single-family dwelling in a targeted county. Purchase price can be no more than $481,176. Gross annual household income must be within applicable limits in effect. All non-borrowing occupants age 18 or older must disclose income and complete Non- Borrowing Occupant Form.KHC ELIGIBILITY AND CREDIT STANDARDS OVERVIEW (Not intended to be an all-inclusive list.)

Home Buyer Eligibility

•

KHC can help both first time and repeat home buyers statewide.

•

Must be a U.S. citizen or legal status to be in U.S.

•

Applicant’s income ONLY through Secondary Market.

•

Property must be the borrower’s principal residence.

•

Borrower cannot own any other residential property at time closing for all loans with MRB Funding.

•

Any Borrower that meets both the income and purchase price limit can have access to Down Payment Assistance.

Kentucky Housing Credit Standards

•

620 minimum credit score required for FHA, VA, & RHS.

•

660 minimum credit score required for Conventional.

•

Debt ratios: 40/50%

•

Collections in most cases do not need to be paid-off in full.

•

Bankruptcies and foreclosures must be discharged two to seven years.

•

Non-taxable income can be grossed-up.

Property Eligibility

•

Both new and existing property.

•

Both new & existing Manufactured Housing.

•

With RHS only new construction Manufactured housing is allowed.

•

Purchase price limit of $481,176 for Secondary Market, MRB Loans, and Tax Credit.

•

Full appraisal required on all KHC loans.

•

With Existing Property, VA is the only loan product that requires a termite inspection.

•

A termite soil treatment certificate is required on ALL new constructionRegular Down Payment Assistance Programs (DAP) Only home buyers obtaining a Kentucky Housing Corporation first mortgage are eligible for DAP funds.Interest Rate with DAP applicable.Eligible KHC Mortgages FHA, RHS, VA, HFA Preferred, & HFA Preferred Plus 80 Income EligibilitySecondary Market or Mortgage Revenue Bond Property Eligibility New and Existing PropertiesBorrower Eligibility First-time and Repeat Home Buyers Amount Up to $10,000Not required to be at maximum LTV first mortgage amount Terms 3.75% amortized over 10 years Purchase Price Limit $481,176 AUSBorrower must qualify with additional monthly payment.With AUS approval, can go up to 40/50% with all loans.Required Repairs Buyer or seller must use OWN funds to pay for repairs DAPMortgage Revenue Bonds (MRB)

- Informational Flyer

- First-time homebuyers statewide in non-targeted areas

- First-time and repeat homebuyers statewide in targeted areas

- 30-year fixed interest rate

- Principal residence ONLY

- Purchase Price Limit: $481,176

- Borrower must meet KHC’s MRB Income Limits

- Insured by the Federal Housing Administration

- 3.5 percent down payment

- KHC DAP applicable

- Upfront and monthly mortgage insurance

- Minimum credit score of 620

- Guaranteed by the Veterans Administration for qualified military veterans

- No down payment if the property appraises for the sales price or greater

- KHC DAP applicable

- Minimum credit score of 620

- No monthly mortgage insurance payments

- Guaranteed by Rural Housing Services (RHS)

- Home must be located in a rural area as defined by RHS

- No down payment if the property appraises for the sales price or greater

- KHC DAP applicable

- Upfront and monthly mortgage insurance

- Minimum credit score of 620

Secondary Market Funding Source

- First-time and repeat homebuyers statewide

- 30-year fixed interest rate

- Principal residence ONLY

- Purchase Price Limit: $481,176

- Borrower must meet KHC’s Secondary Market Income Limits

- Minimum credit score of 660

- 3 percent down payment

- Monthly mortgage insurance (charter coverage)

- KHC DAP applicable

- No minimum borrower contribution

- No reserves required

- 80 percent AMI income

- Minimum credit score of 660

- 3 percent down payment

- Monthly mortgage insurance (standard coverage)

- KHC DAP applicable

- No minimum borrower contribution

- No reserves required

- Secondary Market Income limits apply

- Insured by the Federal Housing Administration

- 3.5 percent down payment

- KHC DAP applicable

- Upfront and monthly mortgage insurance

- Minimum credit score of 620

Refinance Options (Available only through Secondary Market)

- Credit qualifying Streamline Refinance and Rate/Term Refinance

- Insured by the Federal Housing Administration

- Cash back to borrower not to exceed $500

- Upfront and monthly mortgage insurance

- Minimum credit score of 620

- Guaranteed by the Veterans Administration for qualified military veterans

- No down payment if the property appraises for the sales price or greater

- KHC DAP applicable

- Minimum credit score of 620

- No monthly mortgage insurance payments

Refinance Options (Available only through Secondary Market)

- VA IRRRL

- 620 minimum credit score

- No appraisal required

- 30-year term

- VA existing loan

- Guaranteed by Rural Housing Services (RHS)

- Home must be located in a rural area as defined by RHS

- No down payment if the property appraises for the sales price or greater

- KHC DAP applicable

- Upfront and monthly mortgage insurance

- Minimum credit score of 620

Refinance Options (Available only through Secondary Market)

- RHS Streamlined-Assist Refinance Program

- 620 minimum credit score

- No appraisal required

- Must have made timely mortgage payments for the last 12 months

- 30-year term

- RHS existing 502 guaranteed loan

Joel Lobb (NMLS#57916)

Senior Loan OfficerAmerican Mortgage Solutions, Inc.

10602 Timberwood Circle Suite 3

Louisville, KY 40223

Company ID #1364 | MB73346Text/call 502-905-3708

kentuckyloan@gmail.comIf you are an individual with disabilities who needs accommodation, or you are having difficulty using our website to apply for a loan, please contact us at 502-905-3708.

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant’s eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant Equal Opportunity Lender. NMLS#57916

— Some products and services may not be available in all states. Credit and collateral are subject to approval. Terms and conditions apply. This is not a commitment to lend. Programs, rates, terms and conditions are subject to change without notice. The content in this marketing advertisement has not been approved, reviewed, sponsored or endorsed by any department or government agency. Rates are subject to change and are subject to borrower(s) qualification.

Kentucky FHA Loan Requirements

The requirements for Kentucky FHA loans are set by HUD.

- Borrowers must have a steady employment history of the last two years within the same industry or line of work. Recent college graduates can use their transcripts to supplant the 2 year work history rule as long as it makes sense.

- Self-Employed will need a 2 year history of tax returns filed with IRS. They will take a 2 year average.

- FHA requires a 3.5% down payment. Can be gifted from family member or from retirement savings plan, or money saved-up. Any type of cash deposits are not allowed for down payments. No exceptions to this rule!! This is one of the biggest issues I see in FHA underwriting nowadays.

- FHA loans are for primary residence occupancy. Not rental houses.

- Borrowers must have a property appraisal from a FHA-approved appraiser.

- Borrowers’ front-end ratio (mortgage payment plus HOA fees…

View original post 453 more words