A lot of Kentucky homebuyers are hesitant about having their credit pulled because they think it will go down, whereas in most cases, scores are really the same with most Kentucky mortgage lenders. Below I will try to explain to you what mortgage lenders use for credit qualifying scores and why you may have a different credit score and why some lenders may require a higher score than other lenders.

Lastly, each lender must pull their own credit report and cannot use another lender’s credit report or the consumer’s credit report. I will explain the reasoning below.

Does shopping around for a mortgage hurt my credit?

No. Within a 45-day window, multiple credit checks from mortgage lenders are recorded on your credit report as a single inquiry. This is because other lenders realize that you are only going to buy one home.

The impact on your credit is the same no matter how many lenders you consult, as long as the last credit check is within 45 days of the first credit check. Even if a lender needs to check your credit after the 45-day window is over, shopping around is usually still worth it. The effect of an additional inquiry is small, while shopping around for the best deal can save you a lot of money in the long run.

Why do some mortgage lenders require a certain credit score whereas other mortgage lenders may not?

One Word Mortgage Overlays.

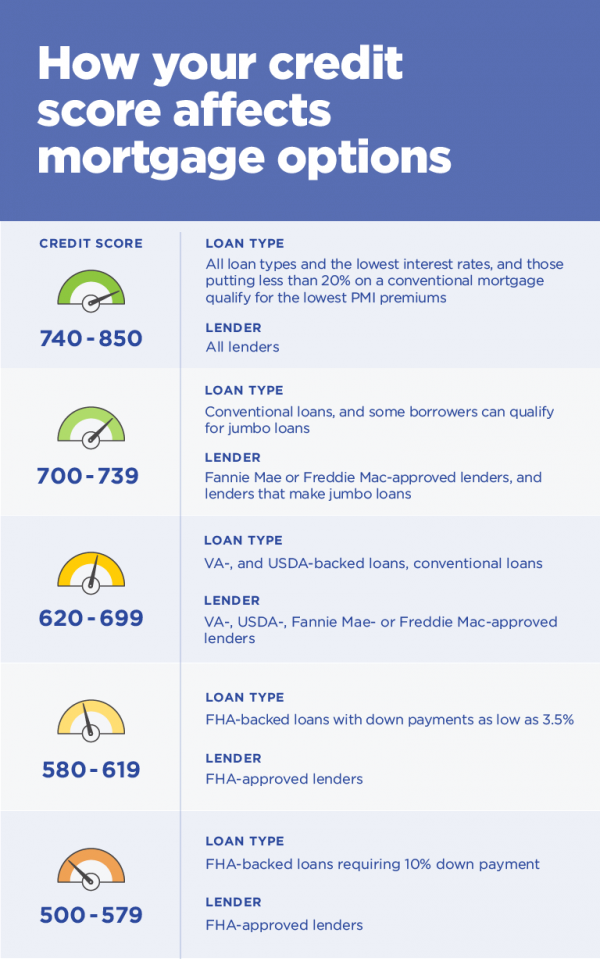

Some Kentucky Mortgage lenders will institute a higher credit score than the minimum below to lessen their risk of having to buy the loan back from the government agencies if they get too many mortgage defaults. In order to protect their lending portfolio and hedging their risk, they will require say a 640 credit score or higher for a FHA loan, whereas the guidelines clearly state you can do a FHA loan with a minimum credit score of 580 To understand mortgage overlays, it helps to have a foundation of how the mortgage approval process works. Mortgage lenders always have underwriting guidelines—standards to determine the amount and terms you qualify for.

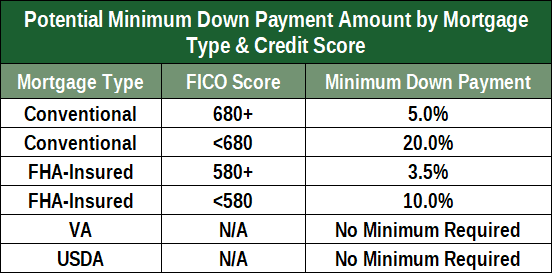

The credit score minimum guidelines for mortgage programs such as FHA, VA, or USDA are crucial factors to consider when applying for a home loan. Each program has its own set of requirements, with the FHA, for instance, having distinct guidelines that applicants must meet. These guidelines are typically based on the specific program’s criteria and are important for potential homebuyers to understand in order to assess their eligibility for the respective mortgage programs. Understanding these credit score minimum guidelines is essential for individuals seeking to navigate the process of securing a mortgage and purchasing a home.

Credit Scores for Kentucky Mortgages

What score does the Mortgage Lender Use? Why may it be different than the one you are seeing?

The reason mortgage lenders use older FICO Scores is because they don’t have a choice. They are essentially forced to use them.

For a bank to sell a mortgage to Fannie Mae or Freddie Mac, FHA VA, USDA, Etc, the loan has to meet certain guidelines. Some of these guidelines require borrowers to have a minimum credit score under specific FICO Score generations.

If you’re planning to apply for a mortgage, be aware that the credit score you see on your application might differ slightly from the one you’re used to.

It might even be different than what comes up when you monitor your credit, or even when you apply for a car loan.

Banks use a slightly different credit score model when evaluating mortgage applicants. Below, we go over what you need to know about credit scores you’re looking to buy a home.

The scoring model used in mortgage applications

While the FICO® 8 model is the most widely used scoring model for general lending decisions, banks use the following FICO scores when you apply for a mortgage:

FICO® Score 2 (Experian)

FICO® Score 5 (Equifax)

FICO® Score 4 (TransUnion)

As you can see, each of the three main credit bureaus (Equifax, Experian and TransUnion) use a slightly different version of the industry-specific FICO Score. That’s because FICO tweaks and tailors its scoring model to best predict the creditworthiness for different industries and bureaus. You’re still evaluated on the same core factors (payment history, credit use, credit mix and age of your accounts), but the categories are weighed a little bit differently.

The FICO 8 model is known for being more critical of high balances on revolving credit lines. Since revolving credit is less of a factor when it comes to mortgages, the FICO 2, 4 and 5 models, which put less emphasis on credit utilization, have proven to be reliable when evaluating good candidates for a mortgage.

Mortgage lenders pull all three reports, from all three bureaus, but they only use one when making their final decision.

“A bank will use all three bureaus,”— “It’s called a tri-merge.”

If all three of your scores are the same, then their choice is simple. But what if your scores are different?

And if you are applying for a mortgage with another person, such as your spouse or partner, each applicant’s FICO 2, 4 and 5 scores are pulled. The bank identifies the median score for both parties, then uses the lowest of the final two.

Joel Lobb Mortgage Loan Officer

American Mortgage Solutions, Inc.

10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/