Are you a first-time homebuyer in Kentucky looking to navigate the world of home loans? Understanding the various types of home loan programs available to you can help you make informed decisions about financing your dream home. In this article, we’ll explore different home loan programs, including their credit score requirements, down payment requirements, bankruptcy considerations, debt-to-income ratio requirements, loan limits, and income limits.

Kentucky FHA Loans

Kentucky FHA Credit Score Requirements:

- Minimum credit score typically ranges from 500 to 580, depending on the lender.

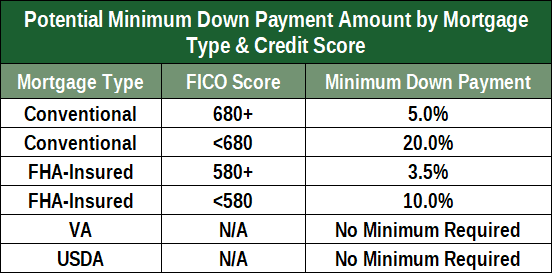

Kentucky FHA Down Payment Requirements:

- A down payment as low as 3.5% of the purchase price is required. 10% down payment required for scores below 580

Kentucky FHA Bankruptcy Requirements:

- Chapter 7 bankruptcy: Generally, two years must have passed since the discharge date.

- Chapter 13 bankruptcy: Typically, one year of on-time payments and approval from the bankruptcy court are required.

Kentucky FHA Debt-to-Income Ratio Requirements:

- Front-end ratio (housing expenses): Up to 31% of gross monthly income.

- Back-end ratio (total monthly debt payments): Up to 43% of gross monthly income.

- Up to 45% and 56% respectively for borrowers with higher credit scores, down payment and reserves along with good residual income

Kentucky FHA Loan Limits and Income Limits:

- Loan limits vary by county and property type. Currently $498,257 in all Kentucky Counties

- Income limits—-No income limits just loan limits.

Kentucky VA Loans

Kentucky VA Credit Score Requirements:

- While there is no official minimum credit score requirement, most lenders prefer a score of 580 to 620 or higher.

Kentucky VA Down Payment Requirements:

- No down payment is required for eligible veterans, active-duty service members, and certain spouses.

Kentucky VA Bankruptcy Requirements:

- Chapter 7 bankruptcy: Generally, two years must have passed since the discharge date.

- Chapter 13 bankruptcy: Typically, one year of on-time payments and approval from the bankruptcy court are required.

Kentucky VA Debt-to-Income Ratio Requirements:

- Flexible debt-to-income ratio requirements, with consideration given to residual income.

Kentucky VA Loan Limits and Income Limits:

- VA loan limits do not apply, but lenders may have their own limits.

- No specific income limits, but income must be sufficient to cover monthly expenses.

Kentucky USDA Loans

Kentucky USDA Credit Score Requirements:

- No minimum score, but credit score typically ranges from 580 and above, depending on the lender.

Kentucky USDA Down Payment Requirements:

- No down payment is required for eligible properties in designated rural areas.

Kentucky USDA Bankruptcy Requirements:

- Chapter 7 bankruptcy: Generally, three years must have passed since the discharge date.

- Chapter 13 bankruptcy: Typically, one year of on-time payments and approval from the bankruptcy court are required.

Kentucky USDA Debt-to-Income Ratio Requirements:

- Maximum total debt-to-income ratio is usually 45%.

Kentucky USDA Loan Limits and Income Limits:

- Loan limits vary by county.

- Income limits are based on area median income and household size.

Kentucky Conventional Loans

Kentucky Conventional Credit Score Requirements:

- Minimum credit score typically ranges from 620 to 680, depending on the lender and loan type.

Kentucky Conventional Down Payment Requirements:

- Down payment requirements can range from 3% to 20% or more, depending on the loan type and borrower qualifications.

Kentucky Conventional Bankruptcy Requirements:

- Chapter 7 bankruptcy: Generally, four years must have passed since the discharge date.

- Chapter 13 bankruptcy: Typically, two years of on-time payments and approval from the bankruptcy court are required.

Debt-to-Income Ratio Requirements:

- Maximum total debt-to-income ratio is typically 43% to 50%, depending on the loan type and borrower qualifications.

Loan Limits and Income Limits:

- Loan limits vary by property type and location.

- No specific income limits, but income must be sufficient to qualify for the loan amount.

Conclusion

As a first-time homebuyer in Kentucky, you have several home loan programs to choose from, each with its own requirements and benefits. Whether you opt for an FHA loan, VA loan, USDA loan, or conventional loan, it’s essential to understand the credit score requirements, down payment requirements, bankruptcy considerations, debt-to-income ratio requirements, loan limits, and income limits associated with each program. Working with a knowledgeable lender can help you navigate the process and find the best loan program for your financial situation and homeownership goals.

Joel Lobb Mortgage Loan Officer

American Mortgage Solutions, Inc.

10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

NMLS 57916 | Company NMLS #1364/MB73346135166/MBR1574The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the view of my employer. Not all products or services mentioned on this site may fit all people.

NMLS ID# 57916, (www.nmlsconsumeraccess.org).