What is an Appraisal?

An appraisal is a valuation of property by an independent, licensed professional known as the appraiser.

The appraiser will review the home itself along with comparable homes in the area and generate a full report on the value of the subject property. They will schedule a visit to inspect, measure, and take photos of the home. An appraisal protects not only the lender’s investment but also you, the buyer.

What if my home doesn’t appraise for the asking sales price?

There are a couple of options in the event that the home value comes in lower than the sales price.

- Review of the report by the real estate agents. Additional comparable home sales or comments are

then submitted to the appraiser for review and comment; - The seller may lower the price of the home;

- The buyer may opt to increase the down payment;

- The numbers stay the same and the loan to value changes. The loan is based on the lower of the

sales price or appraised value. In some situations, a low appraisal does not change the loan terms.

In others, we make an adjustment to the loan itself without changing the sales price or increasing

the down payment; or - A combination of some of the above.

When do I pay for an appraisal?

Appraisers require payment at the time of service. The appraisal funds are collected at the time of order. Even if you opt not to proceed with the home purchase after the appraisal is completed, the appraiser still requires payment. Appraisals have to go through appraisal management companies and the average costs of an appraisals for FHA, VA, USDA and Fannie Mae Home loans in Kentucky around $550 for conventional loans to $600 for Government backed appraisals.

When will I receive a copy of my appraisal?

Appraisals are ordered upon receipt of your intent to proceed, payment and the permission to order (once your home inspection process is complete). Most appraisals are completed in 5-7 business

days.

VA appraisals often take an average of 10 business days to complete. Rush appraisals may be available as needed (subject to additional fee).

What if there are required repairs that need to be done before I can purchase the home?

Typically, repairs will need to be completed before we are able to close and fund your mortgage.

The realtors will negotiate and work together with the seller to make the required repairs to the home. A final inspection by the appraiser will be needed to ensure the work is complete.

What is an inspection and how is it different than an appraisal?

An appraisal is used to determine a home’s market value, while an inspection examines the condition of the home and its components. We always suggest hiring an inspector to show you the functionality and safety features of the home. An inspector will examine items such as the roof, electrical,

plumbing, and appliances.

He or she will note any minor or major repairs that should be addressed

prior to closing.

Locate an Active Kentucky Appraiser👇

Active Appraisers by County – 584K

Active Appraisers by Last Name – 612K

Active Appraisers by City – 586K

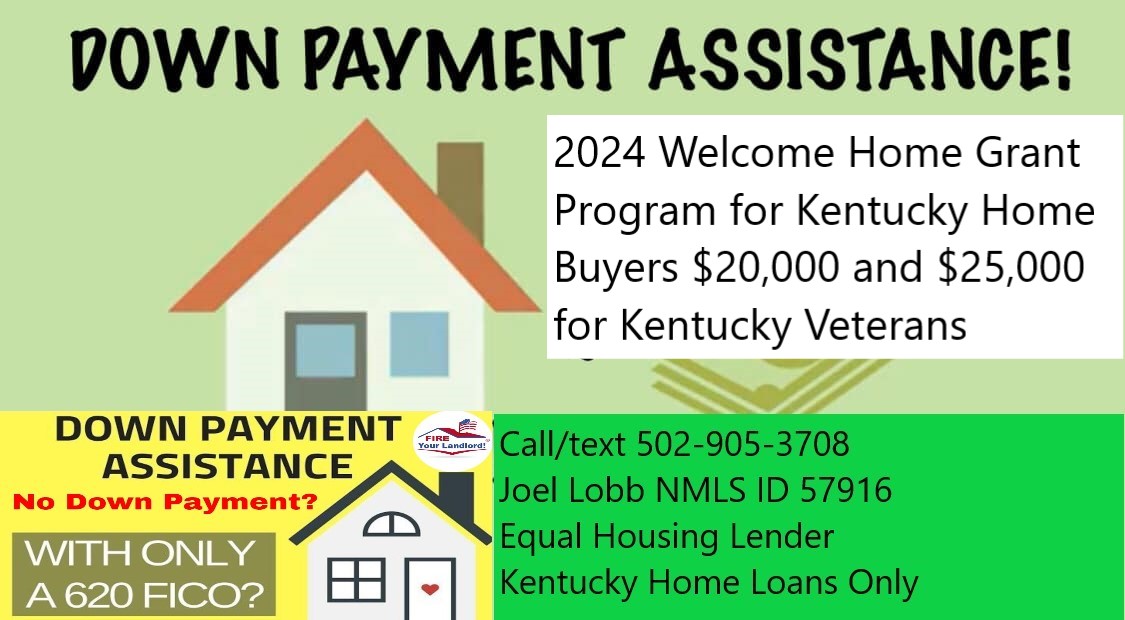

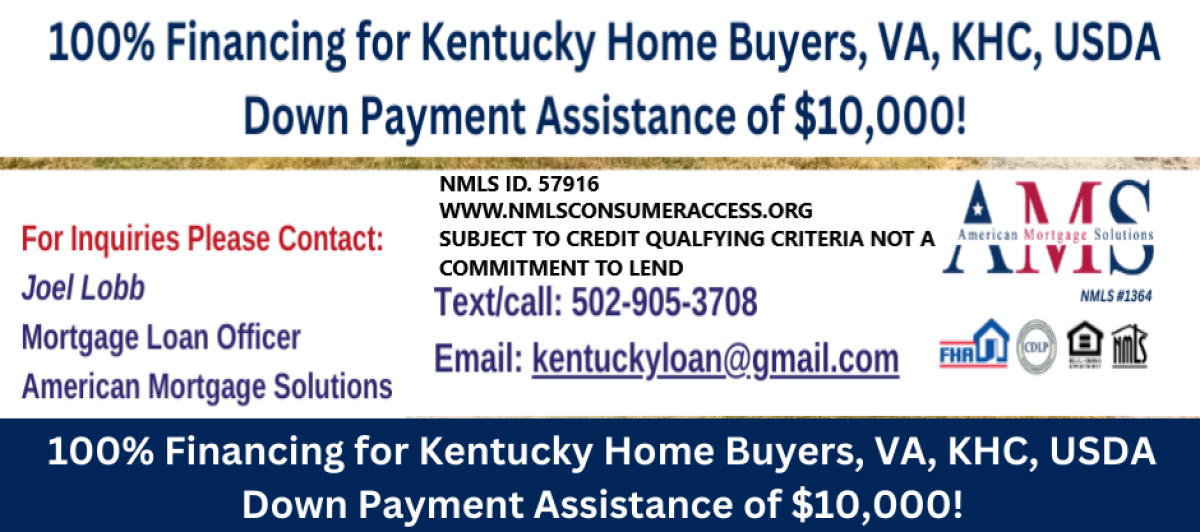

Joel Lobb

Mortgage Loan OfficerIndividual NMLS ID #57916

American Mortgage Solutions, Inc.

10602 Timberwood Circle Louisville, KY 40223

Company NMLS ID #1364

click here for directions to our office

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

https://www.mylouisvillekentuckymortgage.com/

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant’s eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant Equal Opportunity Lender. NMLS#57916 http://www.nmlsconsumeraccess.org/