Are you a first-time homebuyer in Louisville, Kentucky, looking to navigate the complexities of mortgage loans?

Understanding the various loan programs available and their qualifying criteria is crucial.

Let’s explore the key aspects of FHA, VA, and USDA loans, along with their requirements and average rates, tailored to Louisville’s housing market.

FHA Loans for Louisville Homebuyers

Down Payment: FHA loans offer a low down payment option of 3.5%, making homeownership more accessible.

Credit Score: While FHA loans are more lenient with credit scores, a score of 580 or higher is typically required for the 3.5% down payment. Lower credit scores down to 500 may be accepted with a 10% down payment.

Work History and Employment: Lenders typically look for 2 year stable employment and income history to ensure borrowers can repay the loan.

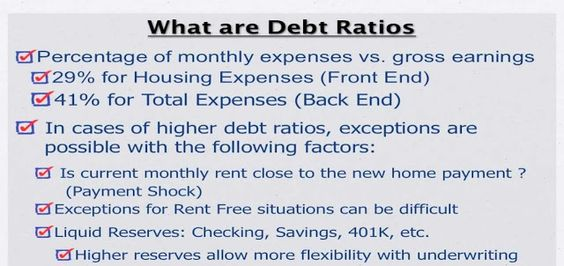

Income Ratio: Your debt-to-income ratio (DTI) should generally be 40% on the front end ratio and 50% on the backed ratio- lower, although some flexibility may exist based on compensating factors.

Bankruptcy and Foreclosure: Previous bankruptcies and foreclosures may not immediately disqualify you but may impact the waiting period before you can apply for an FHA loan. 2 years on Chapter 7, 1 year on Chapter 13, and 3 years on foreclosure.

Time to Close: FHA loans often have a quicker closing process compared to other loan types, typically within 30 to 45 days.

Home Inspections and Appraisal Reports: FHA loans require a home inspection to ensure the property meets safety and livability standards. An appraisal is also necessary to determine the home’s value.

Fixed Rates for 30 Years: FHA loans offer fixed-rate options for 30 years, providing stability in monthly payments.

Mortgage Insurance: FHA loans require both upfront mortgage insurance (UFMIP) and annual mortgage insurance premiums (MIP) no matter how much you put down and is for life of loan. Cheaper mortgage insurance on shorter term loans and larger down payments.

VA Loans for Louisville Homebuyers

Down Payment: VA loans offer a zero-down payment option, making them highly attractive to eligible veterans, active-duty service members, and select spouses.

Credit Score: While VA loans don’t have a credit score requirement, most lenders prefer a score of at least 580 to 620 or higher for smoother approval processes.

Work History and Employment: 2 year Stable employment and income are essential, although VA loans may be more flexible with employment history, especially for veterans.

Income Ratio: The VA typically looks for a DTI of 41% or lower, but exceptions can be made based on compensating factors.

Bankruptcy and Foreclosure: Similar to FHA loans, previous bankruptcies and foreclosures may impact eligibility but may not be automatic disqualifiers. 2 years removed from Chapter 7 and 2 years removed from foreclosure. Chapter 13 one year in plan okay .

Time to Close: VA loans often have competitive closing times, usually within 30 to 60 days.

Home Inspections and Appraisal Reports: VA loans require a VA appraisal to ensure the property meets VA’s minimum property requirements (MPRs) and a pest inspection for termite-related issues. TERMITE REPORT REQUIRED ON ALL VA LOANS.

Fixed Rates for 30 Years: VA loans offer fixed-rate options for 30 years, providing long-term payment predictability.

Mortgage Insurance: VA loans don’t require private mortgage insurance (PMI) but have a VA funding fee, which can be financed into the loan amount.

USDA Loans for Louisville Homebuyers

Down Payment: USDA loans offer a zero-down payment option for eligible rural and suburban homebuyers.

Credit Score: While USDA loans prefer a credit score of 640 or higher, lower scores may be considered with additional documentation.

Work History and Employment: 2 year Stable employment and income are essential for USDA loan approval.

Income Ratio: USDA loans typically require a DTI of 31% to 45% or lower, although exceptions may apply based on compensating factors.

Bankruptcy and Foreclosure: Previous bankruptcies and foreclosures may impact eligibility, and waiting periods may apply. 3 years removed from Chapter 7 and foreclosures, and one year in Chapter 13 okay.

Time to Close: USDA loans may have slightly longer closing times due to rural property eligibility checks and loan processing, often within 45 to 60 days.

Home Inspections and Appraisal Reports: USDA loans require a home inspection and an appraisal to ensure the property meets USDA’s standards. Must meet FHA appraisal requirements.

Fixed Rates for 30 Years: USDA loans offer fixed-rate options for 30 years, providing stability in monthly payments.

Mortgage Insurance: USDA loans require both upfront guarantee fees and annual fees for mortgage insurance, although the rates are typically lower than FHA’s MIP. Mortgage insurance is 1% upfront premium, and .35% a month for life of loan.

Average Rates and Mortgage Insurance Requirements

In Louisville, Kentucky, the average rates for FHA, VA, and USDA loans can vary based on market conditions, lender policies, and borrower qualifications. As of [current date], FHA loan rates in Louisville may range from [range], VA loan rates from [range], and USDA loan rates from [range], all for 30-year fixed-rate loans.

Mortgage insurance requirements differ for each loan type:

- FHA loans require both upfront mortgage insurance premiums (UFMIP) and annual mortgage insurance premiums (MIP).

- VA loans don’t require mortgage insurance but have a funding fee.

- USDA loans require upfront guarantee fees and annual fees for mortgage insurance, often lower than FHA’s MIP.

Conclusion

For first-time homebuyers in Louisville, Kentucky, understanding the qualifying criteria and nuances of FHA, VA, and USDA loans is vital. Each loan type offers unique benefits and considerations, from down payment options to credit score requirements and mortgage insurance. Working with a knowledgeable mortgage broker like Joel Lobb can help streamline the loan process and find the best financing option for your home purchase journey.

Hope your day is full of sunshine

Joel Lobb Mortgage Loan Officer

American Mortgage Solutions, Inc.

10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

NMLS 57916 | Company NMLS #1364/MB73346135166/MBR1574

The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the view of my employer. Not all products or services mentioned on this site may fit all people.

NMLS ID# 57916, (www.nmlsconsumeraccess.org).