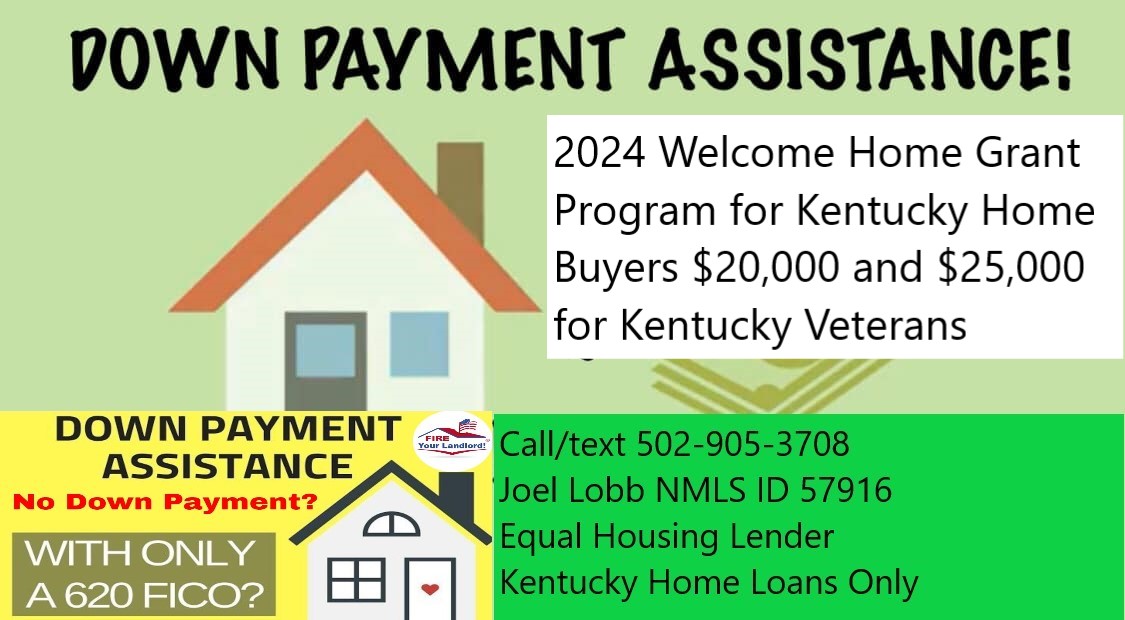

Kentucky Down payment assistance loans are available up to $20,000 for Mortgage with Welcome Home Grant 2024

Information for Kentucky Homebuyers

Welcome Home Program Grant Program for Kentucky Home buyers in 2024

Who are Eligible Homebuyers in Kentucky for the Welcome Grant?

A fully executed (signed by buyer and seller) purchase contract on an eligible property is in hand;

The homebuyer has at least $500 of their own funds to contribute towards down payment and/or closing costs; and,

If a first-time homebuyer (typically anyone who has not owned a home in the last three years), a satisfactory homebuyer counseling course is completed prior to the loan closing. Note: Applicants do not have to be first-time homebuyers.

What is an Eligible Property?

The property is a single family, townhome, condominium, duplex, multi-unit (up to four family units) or a qualified manufactured home. (Manufactured homes may be eligible if they are taxed as real estate and affixed to a permanent foundation); and,

The property is subject to a legally enforceable five-year retention mechanism, included in the Deed or as a Declaration of Restrictive Covenants to the Deed, requiring the FHLB Cincinnati be given notice of any refinancing, sale, foreclosure, deed in-lieu of foreclosure, or change in ownership during the five year retention period.

How Do I Apply?

- HUD Community Development Block Grants (CDBG) — Kentucky contacts: HUD provides grant money to communities and those funds may be used to assist home buyers

- HUD HOME Program — Kentucky contacts: HUD provides grant money to communities designated as participating jurisdictions for assisting home buyers, rental assistance, and other housing initiatives

- Community Ventures Corporation Kentucky Home Financing

- The Kentucky Housing Corporation offers:

- Habitat for Humanity: Through volunteer labor and donations of money and materials, Habitat builds and rehabilitates simple, decent houses with the help of the homeowner (partner) families

- Federal Home Loan Bank of Cincinnati: Serves Kentucky residents by offering various home buying assistance programs, including Welcome Home grants. For more information, you may call 1 (888) 345-2246

- Kentucky Area Development Districts (ADDs): Contact your local ADD to find out more about local home buying assistance programs

- Kentucky Association for Community Action: Helps to fund housing programs for low-income residents

- Federal Appalachian Housing Enterprise (FAHE): Provides housing assistance in rural, low-income, Appalachian communities

- Housing Partnership, Inc.: Provides affordable housing services for residents of Jefferson County

- Secondary financing/down payment assistance programs are listed by state

- USDA Rural Development: Home buying loan programs that reduce the cost of homeownership for low and moderate-income families

Kentucky First Time Home Buyer Common Questions and Answers:

∘ WHAT KIND OF CREDIT SCORE DO I NEED TO QUALIFY FOR DIFFERENT FIRST TIME HOME BUYER LOANS IN KENTUCKY?

∘ DOES IT COSTS ANYTHING TO GET PRE-APPROVED FOR A MORTGAGE LOAN?

∘ HOW LONG DOES IT TAKE TO GET APPROVED FOR A MORTGAGE LOAN IN KENTUCKY?

∘ ARE THERE ANY SPECIAL PROGRAMS IN KENTUCKY THAT HELP WITH DOWN PAYMENT OR NO MONEY DOWN LOANS FOR KY FIRST TIME HOME BUYERS?

∘ WHEN CAN I LOCK IN MY INTEREST RATE TO PROTECT IT FROM GOING UP WHEN I BUY MY FIRST HOME?

∘ HOW MUCH MONEY DO I NEED TO PAY TO CLOSE THE LOAN?

HOW LONG IS MY PRE-APPROVAL GOOD FOR ON A KENTUCKY MORTGAGE LOAN?

HOW MUCH MONEY DO I HAVE TO MAKE TO QUALIFY FOR A MORTGAGE LOAN IN KENTUCKY?

Kentucky Welcome Home Grant 2024 Income Limits for the $20,000 Grant.

see below:👇 hit link for Welcome Home Grants Program 2024

2024 Kentucky Welcome Home Grant Income Limits

Use the 80% limits for the Welcome Home Program

Use the 100% limits for the Disaster Reconstruction Program

| 100% limits | 80% limits | |||||

| 1-2 Persons | 3 + Persons | 1-2 Persons | 3 + Persons | |||

| Adair | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 | ||

| Allen | $ 78,600 | $ 91,420 | $ 62,880 | $ 73,136 | ||

| Anderson | $ 86,270 | $ 99,210 | $ 69,016 | $ 79,368 | ||

| Ballard | $ 80,400 | $ 93,800 | $ 64,320 | $ 75,040 | ||

| Barren | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 | ||

| Bath | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 | ||

| Bell | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 | ||

| Boone | $ 101,100 | $ 116,265 | $ 80,880 | $ 93,012 | ||

| Bourbon | $ 89,300 | $ 102,695 | $ 71,440 | $ 82,156 | ||

| Boyd | $ 83,040 | $ 96,880 | $ 66,432 | $ 77,504 | ||

| Boyle | $ 80,760 | $ 94,220 | $ 64,608 | $ 75,376 | ||

| Bracken | $ 101,100 | $ 116,265 | $ 80,880 | $ 93,012 | ||

| Breathitt | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 | ||

| Breckinridge | $ 87,410 | $ 100,521 | $ 69,928 | $ 80,417 | ||

| Bullitt | $ 89,700 | $ 103,155 | $ 71,760 | $ 82,524 | ||

| Butler | $ 78,600 | $ 91,420 | $ 62,880 | $ 73,136 | ||

| Caldwell | $ 84,480 | $ 98,560 | $ 67,584 | $ 78,848 | ||

| Calloway | $ 82,560 | $ 96,320 | $ 66,048 | $ 77,056 | ||

| Campbell | $ 101,100 | $ 116,265 | $ 80,880 | $ 93,012 | ||

| Carlisle | $ 78,600 | $ 90,860 | $ 62,880 | $ 72,688 | ||

| Carroll | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 | ||

| Carter | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 | ||

| Casey | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 | ||

| Christian | $ 87,590 | $ 100,728 | $ 70,072 | $ 80,582 | ||

| Clark | $ 89,300 | $ 102,695 | $ 71,440 | $ 82,156 | ||

| Clay | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 | ||

| Clinton | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 | ||

| Crittenden | $ 83,760 | $ 97,720 | $ 67,008 | $ 78,176 | ||

| Cumberland | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 | ||

| Daviess | $ 86,950 | $ 99,992 | $ 69,560 | $ 79,994 | ||

| Edmonson | $ 86,650 | $ 99,647 | $ 69,320 | $ 79,718 | ||

| Elliott | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 | ||

| County | 100% limits | 80% limits | ||

| 1-2 Persons | 3 + Persons | 1-2 Persons | 3 + Persons | |

| Estill | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Fayette | $ 89,300 | $ 102,695 | $ 71,440 | $ 82,156 |

| Fleming | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Floyd | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Franklin | $ 85,430 | $ 98,244 | $ 68,344 | $ 78,595 |

| Fulton | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Gallatin | $ 101,100 | $ 116,265 | $ 80,880 | $ 93,012 |

| Garrard | $ 87,210 | $ 100,291 | $ 69,768 | $ 80,233 |

| Grant | $ 79,560 | $ 92,820 | $ 63,648 | $ 74,256 |

| Graves | $ 83,160 | $ 97,020 | $ 66,528 | $ 77,616 |

| Grayson | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Green | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Greenup | $ 83,040 | $ 96,880 | $ 66,432 | $ 77,504 |

| Hancock | $ 86,950 | $ 99,992 | $ 69,560 | $ 79,994 |

| Hardin | $ 86,750 | $ 99,762 | $ 69,400 | $ 79,810 |

| Harlan | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Harrison | $ 87,250 | $ 100,337 | $ 69,800 | $ 80,270 |

| Hart | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Henderson | $ 87,300 | $ 100,395 | $ 69,840 | $ 80,316 |

| Henry | $ 89,700 | $ 103,155 | $ 71,760 | $ 82,524 |

| Hickman | $ 79,560 | $ 92,820 | $ 63,648 | $ 74,256 |

| Hopkins | $ 80,640 | $ 94,080 | $ 64,512 | $ 75,264 |

| Jackson | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Jefferson | $ 89,700 | $ 103,155 | $ 71,760 | $ 82,524 |

| Jessamine | $ 89,300 | $ 102,695 | $ 71,440 | $ 82,156 |

| Johnson | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Kenton | $ 101,100 | $ 116,265 | $ 80,880 | $ 93,012 |

| Knott | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Knox | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Larue | $ 86,750 | $ 99,762 | $ 69,400 | $ 79,810 |

| Laurel | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Lawrence | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Lee | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Leslie | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Letcher | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Lewis | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Lincoln | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Livingston | $ 82,320 | $ 96,040 | $ 65,856 | $ 76,832 |

| Logan | $ 80,760 | $ 94,220 | $ 64,608 | $ 75,376 |

| Lyon | $ 87,310 | $ 100,406 | $ 69,848 | $ 80,325 |

| County | 100% limits | 80% limits | ||

| 1-2 Persons | 3 + Persons | 1-2 Persons | 3 + Persons | |

| McCracken | $ 87,130 | $ 100,199 | $ 69,704 | $ 80,159 |

| McCreary | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| McLean | $ 86,950 | $ 99,992 | $ 69,560 | $ 79,994 |

| Madison | $ 86,910 | $ 99,946 | $ 69,528 | $ 79,957 |

| Magoffin | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Marion | $ 80,760 | $ 94,220 | $ 64,608 | $ 75,376 |

| Marshall | $ 86,030 | $ 98,934 | $ 68,824 | $ 79,147 |

| Martin | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Mason | $ 85,920 | $ 100,240 | $ 68,736 | $ 80,192 |

| Meade | $ 85,790 | $ 98,658 | $ 68,632 | $ 78,926 |

| Menifee | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Mercer | $ 86,730 | $ 99,739 | $ 69,384 | $ 79,791 |

| Metcalfe | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Monroe | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Montgomery | $ 78,600 | $ 91,140 | $ 62,880 | $ 72,912 |

| Morgan | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Muhlenberg | $ 78,600 | $ 91,700 | $ 62,880 | $ 73,360 |

| Nelson | $ 85,170 | $ 97,945 | $ 68,136 | $ 78,356 |

| Nicholas | $ 78,600 | $ 90,860 | $ 62,880 | $ 72,688 |

| Ohio | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Oldham | $ 89,700 | $ 103,155 | $ 71,760 | $ 82,524 |

| Owen | $ 78,600 | $ 91,700 | $ 62,880 | $ 73,360 |

| Owsley | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Pendleton | $ 101,100 | $ 116,265 | $ 80,880 | $ 93,012 |

| Perry | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Pike | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Powell | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Pulaski | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Robertson | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Rockcastle | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Rowan | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Russell | $ 78,600 | $ 90,860 | $ 62,880 | $ 72,688 |

| Scott | $ 89,300 | $ 102,695 | $ 71,440 | $ 82,156 |

| Shelby | $ 92,700 | $ 106,605 | $ 74,160 | $ 85,284 |

| Simpson | $ 82,920 | $ 96,740 | $ 66,336 | $ 77,392 |

| Spencer | $ 89,700 | $ 103,155 | $ 71,760 | $ 82,524 |

| Taylor | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Todd | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Trigg | $ 87,590 | $ 100,728 | $ 70,072 | $ 80,582 |

| Trimble | $ 86,770 | $ 99,785 | $ 69,416 | $ 79,828 |

| County | 100% limits | 80% limits | ||

| 1-2 Persons | 3 + Persons | 1-2 Persons | 3 + Persons | |

| Union | $ 78,600 | $ 91,420 | $ 62,880 | $ 73,136 |

| Warren | $ 86,650 | $ 99,647 | $ 69,320 | $ 79,718 |

| Washington | $ 87,090 | $ 100,153 | $ 69,672 | $ 80,122 |

| Wayne | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Webster | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Whitley | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Wolfe | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Woodford | $ 89,300 | $ 102,695 | $ 71,440 | $ 82,156 |

Joel Lobb Mortgage Loan Officer

American Mortgage Solutions, Inc.

10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the view of my employer. Not all products or services mentioned on this site may fit all people.

NMLS ID# 57916, (www.nmlsconsumeraccess.org).