Shopping for a Kentucky Mortgage Loan?

1. Mortgage Rates Change

Just like the stock market, mortgage rates change throughout the day. Mortgage rates you see today may not be available tomorrow. If you are in the market for a mortgage loan, be sure to check the current rates being offered by lenders. If you have already done your research and have found your dream home consider locking in your rate as soon as possible.

2. Different Lenders Charge Different Fees

Don’t expect every lender to charge the same fees for a mortgage loan. Every lender structures their fees differently, which is why it is important to shop with at least 3 lenders to compare. Next time you apply for a mortgage loan pay attention to the rates, points being charged and closing costs.

3. Lenders Can Sell Your Loan to Another Bank

Many borrowers have experience getting a mortgage loan with a certain lender only to find out that the loan has been sold to another bank. This occurs because lenders need to free up their liabilities in order to make room to give out more loans. This does not affect your mortgage whatsoever, but it’s important to pay close attention to your mortgage statement and any correspondence you receive in the mail to make sure you do not make payments to the wrong bank.

4. Your Middle Credit Score Matters

When you apply for a mortgage loan, the lender will pull your credit scores from three credit bureaus (Transunion, Equifax and Experian) to help them determined if you are credit worthy. Your middle score of the three is what lenders will use for loan qualification. However, the underwriter will review all three scores as part of the loan underwriting process. If you pull your own credit score through a website online, the credit scores displayed to you may be different than what lenders use because they use different reporting systems.

5. You Can Refinance Your Home Loan Anytime

You can refinance your mortgage anytime, but it doesn’t necessarily mean you should. Think about why you want to refinance. Is because you want to lower your monthly payments, to change the type of loan you are in or to take cash out from your equity? Whatever the reason is, make sure that it makes financial sense.

6. You Can Get a Mortgage Loan After a Foreclosure

Many homeowners have experienced a foreclosure after the recent mortgage crisis. There is good news for these borrowers because they can get a mortgage loan after foreclosure. There are waiting periods involved, for example, to apply for an FHA loan you must wait three years after foreclosure to apply. If you want to get a conventional loan the waiting period is seven years from foreclosure. For those seeking a VA loan, the waiting period is two-years.

There are exceptions to the waiting periods, but you have to show the lender that your foreclosure was caused by an event outside your control, such as losing your job or being seriously ill.

8. Good Credit Allows you to Get Better Mortgage Rates

Good credit scores mean a better rate in any type of loan, especially a mortgage loan. Your credit heavily impacts the type mortgage loan you will qualify for. To maintain a good credit report, make sure you monitored it closely. One of the advantages to good credit is that more banks will want to compete for your business, therefore giving you leverage to negotiate the closing costs.

9. Know Your Annual Percentage Rate (APR)

Knowing your APR will allow you see the true cost of your loan. While the interest rate shows the annual cost of your loan, the APR includes other fees such as origination points, admin fees, loan processing fees, underwriting fees, documentation fees, private mortgage insurance and escrow fees.

There may be more or less fees included in the ARP from what we mentioned. To be sure what fees are included in the APR, ask your lender to give you a breakdown of the closing costs included.

10. You Can Always Reduce Closing Costs

One way to reduce closing costs is to have the sellers contribute towards the closing costs when purchasing your home. This can be negotiated between the buyer and the sellers in the purchase contract. The amount the seller can contribute will depend on the type of loan. Another way to save on closing costs is to have the lender give you a credit to cover out of pocket loan costs.

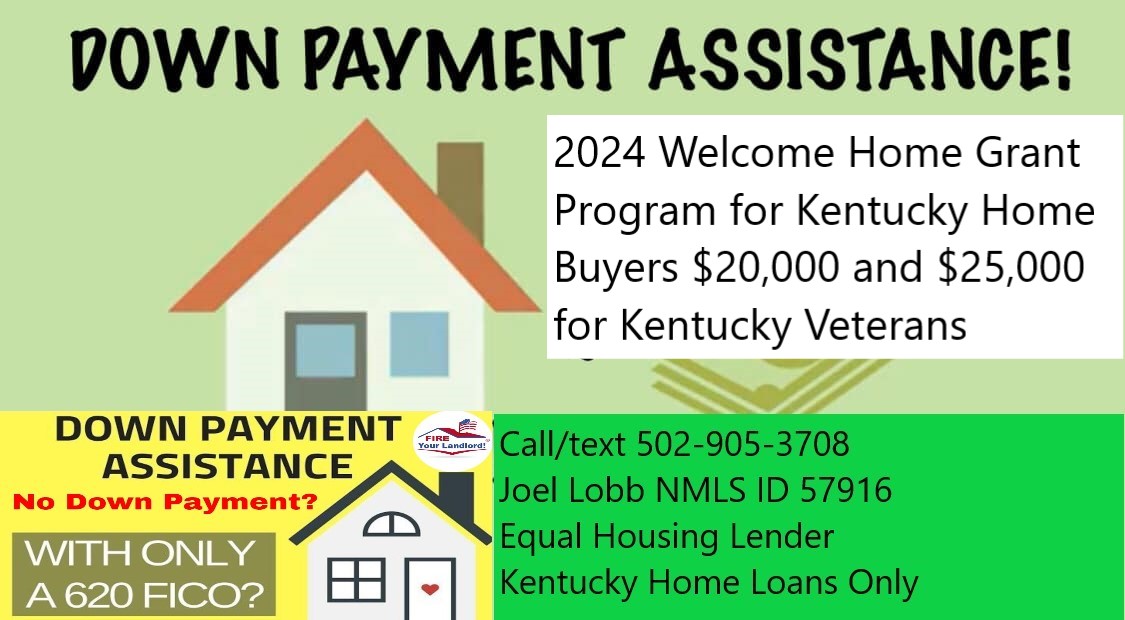

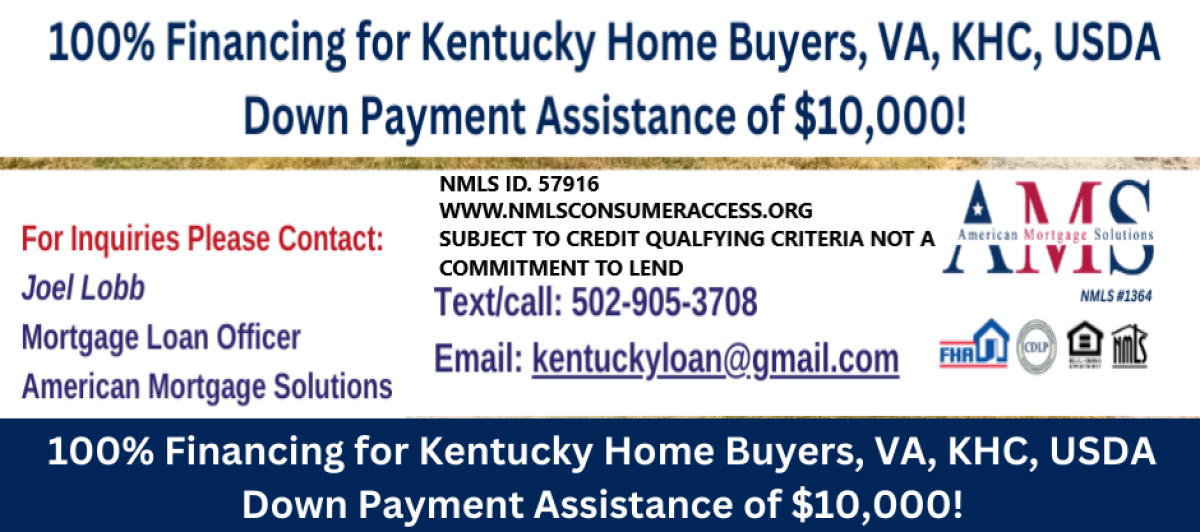

Joel Lobb

Mortgage Loan Officer

Individual NMLS ID #57916

American Mortgage Solutions, Inc.

10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

https://kentuckyloan.blogspot.com

CONFIDENTIALITY NOTICE: This message is covered by the Electronic Communications Privacy Act, Title 18, United States Code, §§ 2510-2521. This e-mail and any attached files are deemed privileged and confidential, and are intended solely for the use of the individual(s) or entity to whom this e-mail is addressed. If you are not one of the named recipient(s) or believe that you have received this message in error, please delete this e-mail and any attached files from all locations in your computer, server, network, etc., and notify the sender IMMEDIATELY at 502-327-9770. Any other use, re-creation, dissemination, forwarding, or copying of this e-mail and any attached files is strictly prohibited and may be unlawful. Receipt by anyone other than the named recipient(s) is not a waiver of any attorney-client, work product, or other applicable privilege. E-mail is an informal method of communication and is subject to possible data corruption, either accidentally or intentionally. Therefore, it is normally inappropriate to rely on legal advice contained in an e-mail without obtaining further confirmation of said advice.