Category: Kentucky Mortgage Rates FHA VA KHC

How long is my pre-approval good for on a Kentucky Mortgage Loan?

When shopping for a Kentucky mortgage loan, keep in mind that mortgage rates can change daily. Different lenders have varying fees, and they may sell your loan to another bank. Your middle credit score is crucial, and good credit leads to better rates. Knowing your Annual Percentage Rate (APR) and reducing closing costs are important. Finally, you can refinance your home loan anytime and get a mortgage loan after a foreclosure with certain waiting periods.

Shopping for a Kentucky Mortgage Loan?

1. Mortgage Rates Change

Just like the stock market, mortgage rates change throughout the day. Mortgage rates you see today may not be available tomorrow. If you are in the market for a mortgage loan, be sure to check the current rates being offered by lenders. If you have already done your research and have found your dream home consider locking in your rate as soon as possible.

2. Different Lenders Charge Different Fees

Don’t expect every lender to charge the same fees for a mortgage loan. Every lender structures their fees differently, which is why it is important to shop with at least 3 lenders to compare. Next time you apply for a mortgage loan pay attention to the rates, points being charged and closing costs.

3. Lenders Can Sell Your Loan to Another Bank

Many borrowers have experience getting a mortgage loan with a certain lender only to find out that the loan has been sold to another bank. This occurs because lenders need to free up their liabilities in order to make room to give out more loans. This does not affect your mortgage whatsoever, but it’s important to pay close attention to your mortgage statement and any correspondence you receive in the mail to make sure you do not make payments to the wrong bank.

4. Your Middle Credit Score Matters

When you apply for a mortgage loan, the lender will pull your credit scores from three credit bureaus (Transunion, Equifax and Experian) to help them determined if you are credit worthy. Your middle score of the three is what lenders will use for loan qualification. However, the underwriter will review all three scores as part of the loan underwriting process. If you pull your own credit score through a website online, the credit scores displayed to you may be different than what lenders use because they use different reporting systems.

5. You Can Refinance Your Home Loan Anytime

You can refinance your mortgage anytime, but it doesn’t necessarily mean you should. Think about why you want to refinance. Is because you want to lower your monthly payments, to change the type of loan you are in or to take cash out from your equity? Whatever the reason is, make sure that it makes financial sense.

6. You Can Get a Mortgage Loan After a Foreclosure

Many homeowners have experienced a foreclosure after the recent mortgage crisis. There is good news for these borrowers because they can get a mortgage loan after foreclosure. There are waiting periods involved, for example, to apply for an FHA loan you must wait three years after foreclosure to apply. If you want to get a conventional loan the waiting period is seven years from foreclosure. For those seeking a VA loan, the waiting period is two-years.

There are exceptions to the waiting periods, but you have to show the lender that your foreclosure was caused by an event outside your control, such as losing your job or being seriously ill.

8. Good Credit Allows you to Get Better Mortgage Rates

Good credit scores mean a better rate in any type of loan, especially a mortgage loan. Your credit heavily impacts the type mortgage loan you will qualify for. To maintain a good credit report, make sure you monitored it closely. One of the advantages to good credit is that more banks will want to compete for your business, therefore giving you leverage to negotiate the closing costs.

9. Know Your Annual Percentage Rate (APR)

Knowing your APR will allow you see the true cost of your loan. While the interest rate shows the annual cost of your loan, the APR includes other fees such as origination points, admin fees, loan processing fees, underwriting fees, documentation fees, private mortgage insurance and escrow fees.

There may be more or less fees included in the ARP from what we mentioned. To be sure what fees are included in the APR, ask your lender to give you a breakdown of the closing costs included.

10. You Can Always Reduce Closing Costs

One way to reduce closing costs is to have the sellers contribute towards the closing costs when purchasing your home. This can be negotiated between the buyer and the sellers in the purchase contract. The amount the seller can contribute will depend on the type of loan. Another way to save on closing costs is to have the lender give you a credit to cover out of pocket loan costs.

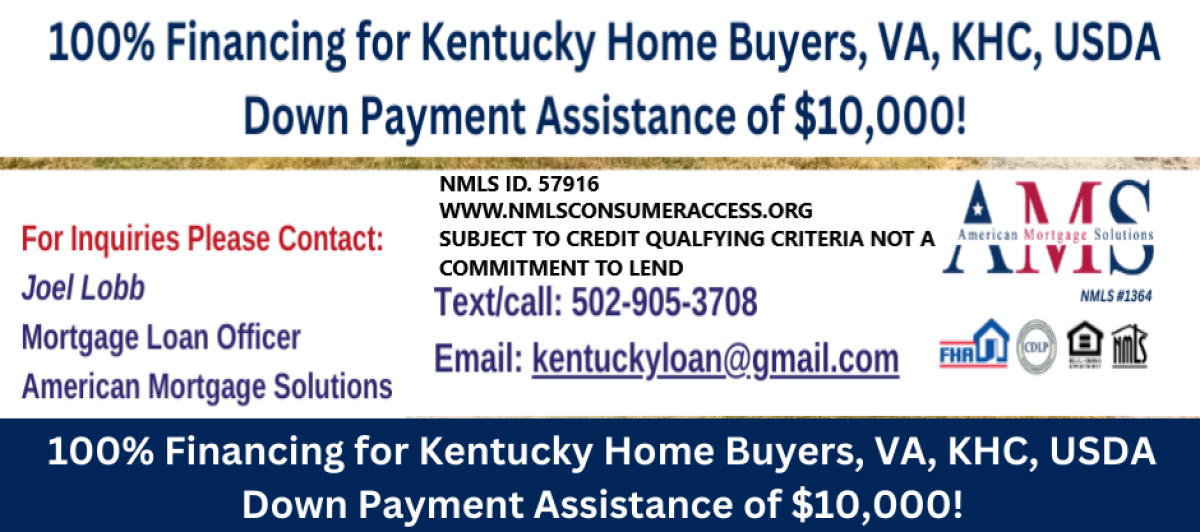

Joel Lobb

Mortgage Loan Officer

Individual NMLS ID #57916

American Mortgage Solutions, Inc.

10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

https://kentuckyloan.blogspot.com

CONFIDENTIALITY NOTICE: This message is covered by the Electronic Communications Privacy Act, Title 18, United States Code, §§ 2510-2521. This e-mail and any attached files are deemed privileged and confidential, and are intended solely for the use of the individual(s) or entity to whom this e-mail is addressed. If you are not one of the named recipient(s) or believe that you have received this message in error, please delete this e-mail and any attached files from all locations in your computer, server, network, etc., and notify the sender IMMEDIATELY at 502-327-9770. Any other use, re-creation, dissemination, forwarding, or copying of this e-mail and any attached files is strictly prohibited and may be unlawful. Receipt by anyone other than the named recipient(s) is not a waiver of any attorney-client, work product, or other applicable privilege. E-mail is an informal method of communication and is subject to possible data corruption, either accidentally or intentionally. Therefore, it is normally inappropriate to rely on legal advice contained in an e-mail without obtaining further confirmation of said advice.

4 Things to Know about buying a house and getting a Kentucky Mortgage Loan approval

Kentucky First-Time Home Buyer Loan Programs

Kentucky First Time Home Buyer Loan Programs for 2024

Kentucky First-Time Home Buyer Loan Programs

There are 4 basic things that a Kentucky-First Time Homebuyers in 2024 needs to show a lender in order to get approved for a mortgage. Each category has so many what-ifs and sub plots that each box can read as its own novel. In other words, each category has so many variables that can affect what it takes to get approved, but without further adieu here are the four categories in no particular order as each without any of these items, you’re pretty much dead in the water:

1. Income

You need income. You need to be able to afford the home. But what is acceptable income? Let’s just say that there are two ratios mortgage underwriters look at to qualify you for mortgage payment:

First Ratio – The first ratio, top ratio or housing ratio. Basically, that means out of all the gross monthly income you make, that no more that X percent of it can go to your housing payment. The housing payment consists of Principle, Interest, Taxes, and Insurance. Whether you escrow or not every one of these items is factored into your ratio. There are a lot of exceptions to how high you can go, but let’s just say that if your ratio is 33% or less, generally, across the board, you’re safe.

Second Ratio- The second ratio, bottom ratio or debt ratio includes the housing payment, but also adds all of the monthly debts that the borrower has. So, it includes housing payment as well as every other debt that a borrower may have. This would include, Auto loans, credit cards, student loans, personal loans, child support, alimony….basically any consistent outgoing debt that you’re paying on. Again, if you’re paying less than 45% of your gross monthly income to all of the debts, plus your proposed housing payment, then……generally, you’re safe. You can go a lot higher in this area, but there are a lot of caveats when increasing your back ratio.

What qualifies as income? Basically, it’s income that has at least a proven, two-year history of being received and pretty high assurances that the income is likely to continue for at least three years. What’s not acceptable? Unverifiable cash income, short term income and income that’s not likely to continue like unemployment income, student loan aid, VA education benefits, or short term disability are not allowed for a mortgage loan.

2. Assets

What the mortgage underwriter is looking for here is how much can you put down and secondly, how much will you have in reserves after the loan is made to help offset any financial emergencies in the future.

Do you have enough assets to put the money forth to qualify for the down payment that the particular program asks for? The only 100% financing or no money down loans still available in Kentucky for home buyers are available through USDA, VA, and KHC or Kentucky Housing Loans. Most other home buyers that don’t qualify for the no money down home loans mentioned above, will turn to the FHA program. FHA loans currently require a 3.5% down payment.

Kentucky Home buyers that have access to putting down at least 5% or more, will usually turn to Fannie Mae or Freddie Mac mortgage programs so they can get better pricing when it comes to mortgage insurance.

These assets need to be validated through bank accounts, 401k or retirements account and sometimes gifts from relatives or employer… Can you borrow the down payment? Sometimes. Generally, if you’re borrowing a secured loan against a secured asset you can use that. But rarely can cash be used as an asset. FHA will allow for gifts from relatives for down payments with little as 3.5% down but Fannie Mae will require a 20% down payment when a gift is being used for the down payment on the home.

The down payment scenarios listed above are for Kentucky Primary Residences only. There are stricter down payment requirements for investment homes made in Kentucky.

3. Credit

- Kentucky FHA Mortgage loan credit score requirements:

- The minimum credit score is 500 for Kentucky FHA loans. However please keep in mind these two things: 1. Lenders credit their own overlays to increase the credit score threshold, most being 580 to 620, and secondly, if your credit score is below 580, you would need 10% minimum down payment, and if the credit score is over 580, then you can go with the minimum 3.5% down payment.

- Obviously, if you have a higher credit score, this will increase your chances of getting approved for a Kentucky FHA Mortgage and possibly better rates and closing costs options.

- Kentucky VA Mortgage loans requirements :

- VA does not have a minimum credit score requirement, but if the credit score is below 620 few lenders will do the loan, but I am set up with several Kentucky VA lenders where I have closed them down to a 580 credit score, but the borrower had good compensating factors such as large down payment, low dti ratios, good job history and good residual income with no previous bankruptcies or foreclosures.

- I would suggest if your credit scores are below 580, I would suggest on working on getting the scores up before you applied for a VA mortgage loan.

- A lot of lenders will do a rapid rescore which in some cases can increase your credit scores in as little as 7-10 working days.

- The federal Department of Veterans Affairs (VA) guarantees loans for current and former members of the military and their families. VA loans provide very favorable terms to eligible borrowers and have limited qualifying requirements. You can get a VA loan with no down payment so long as the home isn’t worth more than you pay for it, and there’s no minimum credit score to qualify. You also don’t have to pay for mortgage insurance, although you do have to pay an up-front funding fee of between .5% and 3.3% of the loan amount unless you fall within an exception for disabled vets or military widows or widowers.

- Kentucky USDA Mortgage credit score requirements:

- According to their guidelines, USDA will go down to a 580 credit score, but most lenders will want a 640 credit score. USDA uses an online system to underwrite the risk of the loan, and scores under 640 are very difficult to get approved.

- Validating the Credit Score. Two or more eligible trade lines are necessary to validate an applicant’s credit report score. Eligible trade lines consist of credit accounts (revolving, installment etc.) with at least 12 months of repayment history reported on the credit report. At least one applicant whose income or assets are used for qualification must have a valid credit report score

- The Rural Housing Service (RHS) operates under the federal Department of Agriculture to guarantee loans for rural home-buyers with limited income who can’t obtain conventional financing. The upside is that Kentucky USDA loans require no down payment. The downside is that they charge a steep up-front fee of 1% of the loan amount (which can be paid off over the entire loan term) and an annual fee of 0.35%.

- Kentucky Fannie Mae and Freddie Mac Conventional Credit Score Requirements

These are considered “conventional loans’ that can be often be obtained with a 3% to 5% down payment. Of course, there are higher standards for conventional home financing.

The most common minimum credit score requirement to get approved today is a 620 FICO. This type of score is typical for people that have high credit card balances or a few delinquent payments in their past. The general consensus on Freddie Mac and Fannie Mae loans in Kentucky is that a 620 score is the entry-point to qualify, but you will need thorough documentation of income with credit scores in the 620 to 640 range.

You will have a better shot to be approved for a mortgage-backed by Fannie or Freddie with a 680-credit score and less strenuous underwriting.

- Competitive Mortgage Rates and Fees

- Monthly Mortgage Insurance Is Not Always Required

- Ideal for First Time Home Buyers with Good Credit

As far as previous Bankruptcies and foreclosures:

Kentucky FHA Mortgage Loans currently requires 3 years removal from a foreclosure or short sale and 2 years on a bankruptcy with good re-established credit.

Kentucky Fannie Mae Mortgage Loans currently requires 4 years removal from bankruptcy, and 7 years on a foreclosure.

Kentucky VA Mortgage Loans currently requires 2 years of removal from bankruptcy or foreclosure with good re established credit.

Kentucky USDA loans require 3 years of removal from bankruptcy and foreclosure with good reestablished credit.

4. Appraisal

Generally, there’s nothing you can do to affect this. The bottom line here is…..” is the value of the house at least the value of what you’re paying for it?” If not, then not good things start to happen. Generally, you’ll find fewer issues with values on purchase transactions, because, in theory, the realtor has done an accurate job of valuing the house prior to taking the listing. The big issue comes in refinancing. In purchase transactions, the value is determined as the

Lower of the value or the contract price!!!

That means that if you buy a $1,000,000 home for $100,000, the value is established at $100,000. Conversely, if you buy a $200,000 home and the value comes in at $180,000 during the appraisal, then the value is established at $180,000. Big issues….Talk to your loan officer.

For each one of these boxes, there are over 1,000 things that can affect if a borrower has reached the threshold to complete that box. So..talk to a great loan officer. There are so many loan officers that don’t know what they’re doing. But, conversely, there’s a lot of great ones as well. Your loan is so important! Get a great lender so that you know, for sure, that the loan you want, can be closed on!

—

Joel Lobb

Mortgage Loan Officer

Mortgage Loan Officer

Individual NMLS ID #57916

American Mortgage Solutions, Inc.

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

email: kentuckyloan@gmail.com

Kentucky FHA Loan Requirements

Kentucky FHA Loan Requirements

The requirements for Kentucky FHA loans are set by HUD.

- Borrowers must have a steady employment history of the last two years within the same industry or line of work. Recent college graduates can use their transcripts to supplant the 2-year work history rule as long as it makes sense.

- Self-Employed will need a 2-year history of tax returns filed with IRS. They will take a 2-year average.

- FHA requires a 3.5% down payment. Can be gifted from family member or from retirement savings plan, or money saved-up. Any type of cash deposits is not allowed for down payments. No exceptions to this rule!! This is one of the biggest issues I see in FHA underwriting nowadays.

- FHA loans are for primary residence occupancy. Not rental houses.

- Borrowers must have a property appraisal from a FHA-approved appraiser.

- Borrowers’ front-end ratio (mortgage payment plus HOA fees, property taxes, mortgage insurance, homeowners’ insurance) needs to be less than 31 percent of their gross income, typically. You may be able to get approved with as high a percentage as 43 percent. If the Automated Underwriting System gives you an Approved Eligible you can go higher on the debt ratios

- Borrowers must have a minimum credit score of 580 for maximum financing with a 3.5% down payment

- Borrowers must have a minimum credit score of 500-579 for maximum LTV of 90 percent with a minimum down payment of 10 percent. Most lenders will not go below 580 to 620 score, and very few lenders will go to 580 score. It’s best to work on getting your scores up before you apply or work with a loan officer to improve them.

- 2 years removed from Chapter 7 is required with good pay history after bankruptcy

- 1 year removed from Chapter 13 is okay with an excellent pay history with the Chapter 13 plan and permission from trustee. You will need to qualify with the Chapter 13 payment along with new house payment. Again, scores will play into your loan pre-approval.

- Typically, borrowers must be three years out of foreclosure and have re-established good credit. Exceptions can be made if there were extenuating circumstances and you’ve improved your credit. If you were unable to sell your home because you had to move to a new area, this does not qualify as an exception to the three-year foreclosure guideline.

FHA

Low Down Payment which can be 100% gift from family member or Grant Program

Seller can pay closing costs-Maximum 6% of purchase price

There is maximum mortgage amount for each county. Check FHA loan limit for your county.

Non-occupant co-signers are allowed on this program.

FHA Approved Condos-Single family home-2-4 unit properties, and PUDs are eligible.

Fast automated underwriting approval available. Also, the file can be manually underwritten by a live person to get loan approval if you do not receive approval through automated underwriting system.

FHA Foreclosure Program

Must be HUD Owned property or FHA Foreclosure in HUD Participating Communities

$100 Down Payment than standard FHA program

580 minimum credit score

Single family, 1-4 unit properties, HUD approved condominiums, and PUDS eligible