How to Secure the Best Mortgage Rate in Kentucky as A First Time Home buyer:

Getting the best Kentucky mortgage rate involves understanding various factors that lenactors to Considerders consider when evaluating loan applications. These factors include credit score, down payment, debt-to-income ratio (DTI), and the term of the loan. Here’s a comprehensive guide on how to improve these aspects to secure the best possible mortgage rate.

1. Credit Score:

Your credit score plays a significant role in determining the interest rate you qualify for. Lenders use credit scores to assess your creditworthiness and the risk associated with lending to you. Generally, the higher your credit score, the lower the interest rate you can secure. Here’s how different credit score ranges typically impact mortgage rates:

- Excellent Credit (780 and above): Aim for a 780 score or higher for the best rates -Borrowers with excellent credit scores usually qualify for the lowest mortgage rates available.

2. Down Payment:

The down payment amount affects your loan-to-value (LTV) ratio, which is the loan amount divided by the property’s appraised value. A higher down payment reduces the lender’s risk, leading to better mortgage rates. Here’s how down payments typically impact mortgage rates:

- 40% or more: A down payment of 40% or more often qualifies you for the best rates and eliminates the need for private mortgage insurance (PMI).

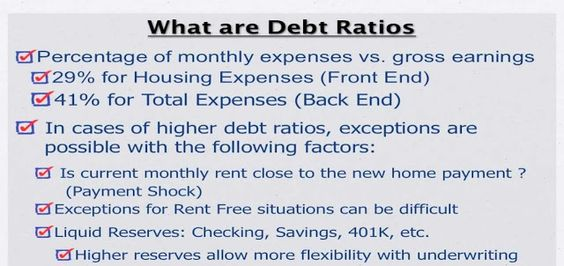

3. Debt-to-Income Ratio (DTI):

Your DTI ratio compares your monthly debt payments to your gross monthly income. Lenders use this ratio to assess your ability to manage monthly mortgage payments alongside existing debts. A lower DTI ratio indicates less financial risk to lenders, potentially leading to better rates. Here’s how to calculate DTI and improve it:

- Calculate Your DTI: Add up all your monthly debt payments (such as credit cards, car loans, student loans) and divide by your gross monthly income.

- Ideal DTI: Generally, a DTI of 45% or lower is considered good by most lenders.

- Improve Your DTI: Paying down debts or increasing your income can lower your DTI ratio, improving your chances of securing a better rate.

4. Term of Loan:

The term of your loan, such as 15-year or 30-year, also influences the interest rate. Shorter loan terms often come with lower interest rates but higher monthly payments. Longer terms may have slightly higher rates but offer lower monthly payments.

In conclusion, to get the best Kentucky mortgage rate:

- Maintain a high credit score by managing credit responsibly. Shoot for 780 or higher for the best mortgage rate on a conventional loan

- Save for a substantial down payment to reduce the loan amount and LTV ratio. To get the best rate, usually 40% down will get you the best rates on a Conventional loan.

- Keep your DTI ratio low by managing debts and increasing income where possible. Try to keep the debt to income ratio less than 45%

- The above scenarios are for conventional loans. Rates could vary for VA, USDA, and FHA mortgage loans due to there mortgage insurance being the same for each borrower whereas conventional loans sway more toward the down payment, credit score, and debt to income ratio.

- Keep in mind shorter term loans, i.e. 15 year loans vs 30 year loans will get you a better rate for all types of loans

- Larger loan amounts will yield better rates vs small loan amounts due to the profits involved in the secondary market for the above loans and how lenders are paid.

Best mortgage rates in Kentucky for FHA, VA, USDA and Conventional Home Loans-

Joel Lobb Mortgage Loan Officer

American Mortgage Solutions, Inc.

10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

fax: 502-327-9119

email:kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the view of my employer. Not all products or services mentioned on this site may fit all people.

NMLS ID# 57916, (www.nmlsconsumeraccess.org).