Category: Mortgage Insurance FHA

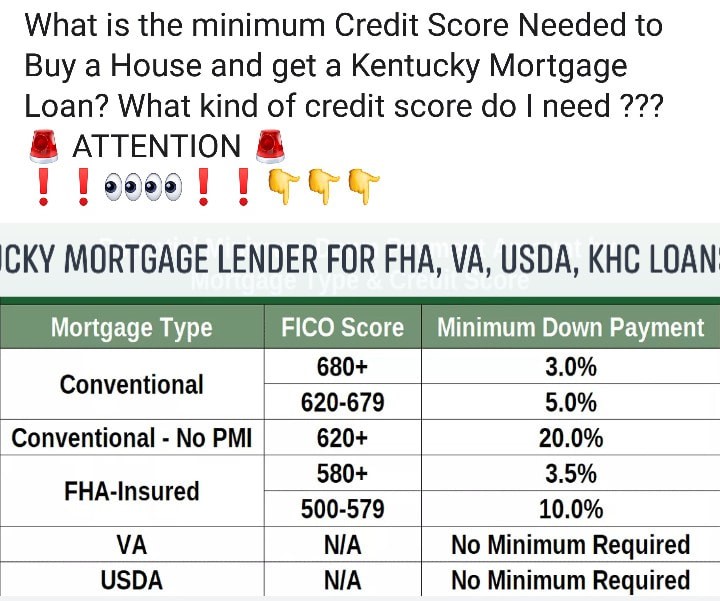

What is the minimum credit score I need to qualify for a Kentucky FHA, VA, USDA and KHC Conventional mortgage loan?

What is the minimum credit score I need to qualify for a Kentucky mortgage currently?

Question:

What is the current minimum credit scores needed to qualify for a Kentucky mortgage Loan?

Answer:

The minimum credit score needed to qualify for a Kentucky mortgage depends on the type of loan program you are looking to obtain, this could be the reason that you have received conflicting answers.

The most common types of mortgage are Conventional, FHA, USDA, VA, and KHC mortgage loans in Kentucky. I’ll explain each briefly below and the minimum credit score needed to qualify for each loan program. Keep in mind these are continuously changing and can vary by lender do to credit overlays.

Kentucky Conventional or Fannie Mae

Conventional loans make up the majority of mortgages in the US. They are also known as conforming loans, because they conform to specific guidelines set by Fannie Mae and Freddie Mac.

- Minimum Credit Score is 620

- What Are the Conforming Loan Limits for 2024?

Property Type Minimum Conforming Loan Limit Maximum Conforming Loan Limit

One-unit $766,550 $1,149,825

Two-unit $981,500 $1,472,250

Three-unit $1,186,350 $1,779,525

Four-unit $1,474,400 $2,211,600 - You can use a conventional loan to buy a primary residence, second home, or rental property

- Conventional loans are available in fixed rates, adjustable rates (ARMs), and offer many loan terms usually from 10 to 30 years

- Down payments as low as 3% and 5% depending on Home Ready or straight conventional loan.

- No monthly mortgage insurance with a down payment of at least 20%

- Max Debt to Income Ratio of 50%

KENTUCKY FHA MORTGAGE

An FHA loan is a mortgage issued by federally qualified lenders and insured by the Federal Housing Administration (FHA). FHA loans are designed for low-to-moderate income borrowers who are unable to make a large down payment.

- Minimum Credit Score is 500 with at least 10% down

- Minimum Credit Score is 580 if you put less than 10% down

- The maximum loan amount varies by Geographical Area, for 2024 is $498,257

- Upfront and Monthly Mortgage Insurance is required regardless of the Loan to Value

- FHA Loans are only available for financing primary residences

- Maximum Debt to Income Ratio of 50% (unless mitigating factors justify allowing a higher DTI) up to 57% in some instances with strong compensating factors.

KENTUCKY USDA RURAL HOUSING LOAN

-

- 100% Financing

- Cities and towns located outside metro areas-see link (https://eligibility.sc.egov.usda.gov/eligibility/welcomeAction.do?pageAction=sfp

- Do NOT have to be a Kentucky First Time Home Buyer

- No Down Payment

- 30 year low fixed rate loans

- No Prepayment Penalty

- Great Low FIXED Interest Rates

- No max loan limits, just income limits

- Possible to Roll Closing Costs into Loan if Appraises Higher

- No Cash Reserves Required

- UNLIMITED Seller Contribution toward Closing Costs

- 100% Gifted Closing Costs allowed

- Primary Residents only (no rentals/investment properties)

- Debt to income ratios no more than 45% with GUS approval and 29 and 41% with a manual underwrite.

- Only Need a 580 Credit Score to Apply*** Most USDA loans need a 620 or score higher to get approved through their automated underwriting system called GUS. 640 usually required for an automated approval upfront.

- No bankruptcies (Chapter 7) last 3 years and no foreclosure last 3 years. If Chapter 13 bankruptcy possible to go on after 1 year

-

KENTUCKY VA Mortgage

- 100% Financing Available up to qualifying income and entitlement

- Must be eligible veteran with Certificate of Eligibility. We can help get this for veterans or active duty personnel.

- No Down Payment Required

- Seller Can Pay ALL Your Closing Costs

- No Monthly Mortgage Insurance

- Minimum 580 typically Credit Score to Apply–VA does not have a minimum credit score but lenders will create credit overlays to protect their interest.

- Active Duty, Reserves, National Guard, & Retired Veterans Can Apply

- No bankruptcies or foreclosures in last 2 years and a clear CAVIRS

- Debt to income ratios vary, but usually 55% back-end ratio with a fico score over 620 will get it done on qualifying income and if it is a manual underwrite, 29% and 41% respectively

- Can use your VA loan guaranty more than once, and in some cases, can have two existing VA loans out at they same time. Call or email for more info on this scenario.

- Cost of VA loan appraisal in Kentucky now costs a minimum $605 with a termite report needed on all purchase and refinance transactions unless a condo.

- 2 year work history needed on VA loans unless you can show a legitimate excuse, ie. off work due to injury, schooling, education etc.

- You cannot use your GI Bill for income qualifying for the mortgage payment.

KENTUCKY HOUSING DOWN PAYMENT ASSISTANCE 100 FINANCING

Down Payment: There are still housing programs that exist for Kentucky home buyers whereas you can purchase a home with no down payment. You will need a 620 mid credit score to purchase a home using the KHC loan programs for their no down payment credit requirements.

How the Down Payment Assistance Program (DAP) Works

Down payment assistance loans are available up to $10,000 and is paid back over a period of ten years at a current rate of 3.75%.

Regular DAP

- Purchase price up to $481,176 with Secondary Market or Mortgage Revenue Bond (MRB) income limits.

- Assistance in the form of a loan up to $10,000 in $100 increments.

- Repayable over a 10-year term at 3.75 percent.

- Available to all KHC first-mortgage loan recipients

If you have questions about qualifying as first time home buyer in Kentucky, please call, text, email or fill out free prequalification below for your next mortgage loan pre-approval.

The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the views of my employer. Not all products or services mentioned on this site may fit all people

Kentucky FHA Loan Requirements for 2024

Originally posted on Kentucky FHA Mortgage Lender:

Kentucky FHA Loan Requirements The requirements for Kentucky FHA loans are set by HUD. Borrowers must have a steady employment history of the last two years within the same industry or line of work. Recent college graduates can use their transcripts to supplant the 2 year work history…

Kentucky FHA Loan Requirements for 2024 to include Credit Fico Scores, Down Payment, Income and Job history

FHA

An FHA loan is a mortgage issued by federally qualified lenders and insured by the Federal Housing Administration (FHA). FHA loans are designed for low-to-moderate income borrowers who are unable to make a large down payment.

- Minimum Credit Score is 500 with at least 10% down

- Minimum Credit Score is 580 if you put less than 10% down

FHA Guidelines

- Upfront and Monthly Mortgage Insurance is required regardless of the Loan to Value

- FHA Loans are only available for financing primary residences

- Maximum Debt to Income Ratio of 50% (unless mitigating factors justify allowing a higher DTI)

Kentucky FHA Loan Requirements

The requirements for Kentucky FHA loans are set by HUD.

- Borrowers must have a steady employment history of the last two years within the same industry or line of work. Recent college graduates can use their transcripts to supplant the 2-year work history rule as long as it makes sense.

- Self-Employed will need a 2-year history of tax returns filed with IRS. They will take a 2-year average.

- FHA requires a 3.5% down payment. Can be gifted from family member or from retirement savings plan, or money saved-up. Any type of cash deposits is not allowed for down payments. No exceptions to this rule!! This is one of the biggest issues I see in FHA underwriting nowadays.

- FHA loans are for primary residence occupancy. Not rental houses.

- Borrowers must have a property appraisal from a FHA-approved appraiser.

- Borrowers’ front-end ratio (mortgage payment plus HOA fees, property taxes, mortgage insurance, homeowners’ insurance) needs to be less than 31 percent of their gross income, typically. You may be able to get approved with as high a percentage as 43 percent. If the Automated Underwriting System gives you an Approved Eligible you can go higher on the debt ratios

- Borrowers must have a minimum credit score of 580 for maximum financing with a 3.5% down payment

- Borrowers must have a minimum credit score of 500-579 for maximum LTV of 90 percent with a minimum down payment of 10 percent. Most lenders will not go below 580 to 620 score, and very few lenders will go to 580 score. It’s best to work on getting your scores up before you apply or work with a loan officer to improve them.

- 2 years removed from Chapter 7 is required with good pay history after bankruptcy

- 1 year removed from Chapter 13 is okay with an excellent pay history with the Chapter 13 plan and permission from trustee. You will need to qualify with the Chapter 13 payment along with new house payment. Again, scores will play into your loan pre-approval.

- Typically, borrowers must be three years out of foreclosure and have re-established good credit. Exceptions can be made if there were extenuating circumstances and you’ve improved your credit. If you were unable to sell your home because you had to move to a new area, this does not qualify as an exception to the three-year foreclosure guideline.

FHA

Low Down Payment which can be 100% gift from family member or Grant Program

Seller can pay closing costs-Maximum 6% of purchase price

There is maximum mortgage amount for each county. Check FHA loan limit for your county.

Non-occupant co-signers are allowed on this program.

FHA Approved Condos-Single family home-2-4 unit properties, and PUDs are eligible.

Fast automated underwriting approval available. Also, the file can be manually underwritten by a live person to get loan approval if you do not receive approval through automated underwriting system.FHA Foreclosure Program

Must be HUD Owned property or FHA Foreclosure in HUD Participating Communities

$100 Down Payment than standard FHA program

580 minimum credit score

Single family, 1-4 unit properties, HUD approved condominiums, and PUDS eligible2. Kentucky Housing Corporation Down Payment Assistance for 2024.

Kentucky Down payment assistance loans are available up to $10,000 for Mortgage

KHC recognizes that down payments, closing costs, and prepaids are stumbling blocks for many potential home buyers. We offer a special loan program to help with those. Your KHC-approved lender can help you apply.

Eligibility: Both first-time and repeat home buyers purchasing a single-family dwelling. Purchase price can be no more than $481,176. Applicant’s income must be within applicable secondary market limits in effect. If KHC’s Homebuyer Tax Credit is used, then household income must be under the Homebuyer Tax Credit income limits.

Mortgage Revenue Bond (MRB) First Mortgage Products Eligibility: Must be a first-time home buyer, unless purchasing a single-family dwelling in a targeted county. Purchase price can be no more than $481,176. Gross annual household income must be within applicable limits in effect. All non-borrowing occupants age 18 or older must disclose income and complete Non- Borrowing Occupant Form.KHC ELIGIBILITY AND CREDIT STANDARDS OVERVIEW (Not intended to be an all-inclusive list.)

Home Buyer Eligibility

•

KHC can help both first time and repeat home buyers statewide.

•

Must be a U.S. citizen or legal status to be in U.S.

•

Applicant’s income ONLY through Secondary Market.

•

Property must be the borrower’s principal residence.

•

Borrower cannot own any other residential property at time closing for all loans with MRB Funding.

•

Any Borrower that meets both the income and purchase price limit can have access to Down Payment Assistance.

Kentucky Housing Credit Standards

•

620 minimum credit score required for FHA, VA, & RHS.

•

660 minimum credit score required for Conventional.

•

Debt ratios: 40/50%

•

Collections in most cases do not need to be paid-off in full.

•

Bankruptcies and foreclosures must be discharged two to seven years.

•

Non-taxable income can be grossed-up.

Property Eligibility

•

Both new and existing property.

•

Both new & existing Manufactured Housing.

•

With RHS only new construction Manufactured housing is allowed.

•

Purchase price limit of $481,176 for Secondary Market, MRB Loans, and Tax Credit.

•

Full appraisal required on all KHC loans.

•

With Existing Property, VA is the only loan product that requires a termite inspection.

•

A termite soil treatment certificate is required on ALL new constructionRegular Down Payment Assistance Programs (DAP) Only home buyers obtaining a Kentucky Housing Corporation first mortgage are eligible for DAP funds.Interest Rate with DAP applicable.Eligible KHC Mortgages FHA, RHS, VA, HFA Preferred, & HFA Preferred Plus 80 Income EligibilitySecondary Market or Mortgage Revenue Bond Property Eligibility New and Existing PropertiesBorrower Eligibility First-time and Repeat Home Buyers Amount Up to $10,000Not required to be at maximum LTV first mortgage amount Terms 3.75% amortized over 10 years Purchase Price Limit $481,176 AUSBorrower must qualify with additional monthly payment.With AUS approval, can go up to 40/50% with all loans.Required Repairs Buyer or seller must use OWN funds to pay for repairs DAPMortgage Revenue Bonds (MRB)

- Informational Flyer

- First-time homebuyers statewide in non-targeted areas

- First-time and repeat homebuyers statewide in targeted areas

- 30-year fixed interest rate

- Principal residence ONLY

- Purchase Price Limit: $481,176

- Borrower must meet KHC’s MRB Income Limits

- Insured by the Federal Housing Administration

- 3.5 percent down payment

- KHC DAP applicable

- Upfront and monthly mortgage insurance

- Minimum credit score of 620

- Guaranteed by the Veterans Administration for qualified military veterans

- No down payment if the property appraises for the sales price or greater

- KHC DAP applicable

- Minimum credit score of 620

- No monthly mortgage insurance payments

- Guaranteed by Rural Housing Services (RHS)

- Home must be located in a rural area as defined by RHS

- No down payment if the property appraises for the sales price or greater

- KHC DAP applicable

- Upfront and monthly mortgage insurance

- Minimum credit score of 620

Secondary Market Funding Source

- First-time and repeat homebuyers statewide

- 30-year fixed interest rate

- Principal residence ONLY

- Purchase Price Limit: $481,176

- Borrower must meet KHC’s Secondary Market Income Limits

- Minimum credit score of 660

- 3 percent down payment

- Monthly mortgage insurance (charter coverage)

- KHC DAP applicable

- No minimum borrower contribution

- No reserves required

- 80 percent AMI income

- Minimum credit score of 660

- 3 percent down payment

- Monthly mortgage insurance (standard coverage)

- KHC DAP applicable

- No minimum borrower contribution

- No reserves required

- Secondary Market Income limits apply

- Insured by the Federal Housing Administration

- 3.5 percent down payment

- KHC DAP applicable

- Upfront and monthly mortgage insurance

- Minimum credit score of 620

Refinance Options (Available only through Secondary Market)

- Credit qualifying Streamline Refinance and Rate/Term Refinance

- Insured by the Federal Housing Administration

- Cash back to borrower not to exceed $500

- Upfront and monthly mortgage insurance

- Minimum credit score of 620

- Guaranteed by the Veterans Administration for qualified military veterans

- No down payment if the property appraises for the sales price or greater

- KHC DAP applicable

- Minimum credit score of 620

- No monthly mortgage insurance payments

Refinance Options (Available only through Secondary Market)

- VA IRRRL

- 620 minimum credit score

- No appraisal required

- 30-year term

- VA existing loan

- Guaranteed by Rural Housing Services (RHS)

- Home must be located in a rural area as defined by RHS

- No down payment if the property appraises for the sales price or greater

- KHC DAP applicable

- Upfront and monthly mortgage insurance

- Minimum credit score of 620

Refinance Options (Available only through Secondary Market)

- RHS Streamlined-Assist Refinance Program

- 620 minimum credit score

- No appraisal required

- Must have made timely mortgage payments for the last 12 months

- 30-year term

- RHS existing 502 guaranteed loan

Joel Lobb (NMLS#57916)

Senior Loan OfficerAmerican Mortgage Solutions, Inc.

10602 Timberwood Circle Suite 3

Louisville, KY 40223

Company ID #1364 | MB73346Text/call 502-905-3708

kentuckyloan@gmail.comIf you are an individual with disabilities who needs accommodation, or you are having difficulty using our website to apply for a loan, please contact us at 502-905-3708.

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant’s eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant Equal Opportunity Lender. NMLS#57916

— Some products and services may not be available in all states. Credit and collateral are subject to approval. Terms and conditions apply. This is not a commitment to lend. Programs, rates, terms and conditions are subject to change without notice. The content in this marketing advertisement has not been approved, reviewed, sponsored or endorsed by any department or government agency. Rates are subject to change and are subject to borrower(s) qualification.

Kentucky FHA Loan Requirements

The requirements for Kentucky FHA loans are set by HUD.

- Borrowers must have a steady employment history of the last two years within the same industry or line of work. Recent college graduates can use their transcripts to supplant the 2 year work history rule as long as it makes sense.

- Self-Employed will need a 2 year history of tax returns filed with IRS. They will take a 2 year average.

- FHA requires a 3.5% down payment. Can be gifted from family member or from retirement savings plan, or money saved-up. Any type of cash deposits are not allowed for down payments. No exceptions to this rule!! This is one of the biggest issues I see in FHA underwriting nowadays.

- FHA loans are for primary residence occupancy. Not rental houses.

- Borrowers must have a property appraisal from a FHA-approved appraiser.

- Borrowers’ front-end ratio (mortgage payment plus HOA fees…

View original post 453 more words

Kentucky FHA Loan Requirements

Kentucky FHA Loan Requirements

The requirements for Kentucky FHA loans are set by HUD.

- Borrowers must have a steady employment history of the last two years within the same industry or line of work. Recent college graduates can use their transcripts to supplant the 2-year work history rule as long as it makes sense.

- Self-Employed will need a 2-year history of tax returns filed with IRS. They will take a 2-year average.

- FHA requires a 3.5% down payment. Can be gifted from family member or from retirement savings plan, or money saved-up. Any type of cash deposits is not allowed for down payments. No exceptions to this rule!! This is one of the biggest issues I see in FHA underwriting nowadays.

- FHA loans are for primary residence occupancy. Not rental houses.

- Borrowers must have a property appraisal from a FHA-approved appraiser.

- Borrowers’ front-end ratio (mortgage payment plus HOA fees, property taxes, mortgage insurance, homeowners’ insurance) needs to be less than 31 percent of their gross income, typically. You may be able to get approved with as high a percentage as 43 percent. If the Automated Underwriting System gives you an Approved Eligible you can go higher on the debt ratios

- Borrowers must have a minimum credit score of 580 for maximum financing with a 3.5% down payment

- Borrowers must have a minimum credit score of 500-579 for maximum LTV of 90 percent with a minimum down payment of 10 percent. Most lenders will not go below 580 to 620 score, and very few lenders will go to 580 score. It’s best to work on getting your scores up before you apply or work with a loan officer to improve them.

- 2 years removed from Chapter 7 is required with good pay history after bankruptcy

- 1 year removed from Chapter 13 is okay with an excellent pay history with the Chapter 13 plan and permission from trustee. You will need to qualify with the Chapter 13 payment along with new house payment. Again, scores will play into your loan pre-approval.

- Typically, borrowers must be three years out of foreclosure and have re-established good credit. Exceptions can be made if there were extenuating circumstances and you’ve improved your credit. If you were unable to sell your home because you had to move to a new area, this does not qualify as an exception to the three-year foreclosure guideline.

FHA

Low Down Payment which can be 100% gift from family member or Grant Program

Seller can pay closing costs-Maximum 6% of purchase price

There is maximum mortgage amount for each county. Check FHA loan limit for your county.

Non-occupant co-signers are allowed on this program.

FHA Approved Condos-Single family home-2-4 unit properties, and PUDs are eligible.

Fast automated underwriting approval available. Also, the file can be manually underwritten by a live person to get loan approval if you do not receive approval through automated underwriting system.

FHA Foreclosure Program

Must be HUD Owned property or FHA Foreclosure in HUD Participating Communities

$100 Down Payment than standard FHA program

580 minimum credit score

Single family, 1-4 unit properties, HUD approved condominiums, and PUDS eligible

How to Qualify For A Kentucky Mortgage Loan

Conventional loans follow guidelines set by government-sponsored enterprises Fannie Mae and Freddie Mac.

FHA loans are insured by the Federal Housing Administration.

VA loans are guaranteed by the U.S. Department of Veterans Affairs.

USDA loans are backed by the U.S. Department of Agriculture to finance homes in USDA-eligible rural area

When it comes to get a mortgage loan in Kentucky, lenders will look at your credit, income and work history, and assets (money in the bank, 401k etc)

Debt to Income Ratio For Mortgage Loans.

DTI ratio. Lenders divide your total debt by your pretax income to determine your DTI ratio. It’s an important measure used to determine whether you can repay the loan.

Most mortgages loans in the Secondary Market are ran through an Automated Underwriting System called Desktop Underwriting for Conventional, FHA, VA mortgage loans and GUS for USDA loans for a pre-approval (GUS, DU, DO LP) and it will state your max house payment in relation to your gross monthly income vs. monthly payments on the credit report. Car insurance, utilities bills, cell phone, internet, net flix etc, is not part of the debt to income requirements.

Most ratios have a front end and back end requirement, with 40% to 45% on the high-end and 55% on the backend ratio if you get a underwriting recommendation of Approved Eligible.

Lower the credit score, reserves, job history, the lower the debt to income ratio will need to be.

If you get a Refer/Eligible automated underwriting , recommendation which is called a manual underwrite , the debt to income ratios will need to be around 29-31% on the front end ratio (house payment with piti) and the back end ratio will need to be no more than 43% (new house payment plus monthly payments on the credit report, and child support if applicable).

- Kentucky FHA Mortgage loan credit score requirements:

- The minimum credit score is 500 for Kentucky FHA loans. However please keep in mind these two things: 1. Lenders credit their own overlays to increase the credit score threshold, most being 620, and secondly, if your credit score is below 580, you would need 10% minimum down payment, and if the credit score is over 580, then you can go with the minimum 3.5% down payment.

- Obviously, if you have a higher credit score, this will increase your chances of getting approved for a Kentucky FHA Mortgage and possibly better rates and closing costs options.

- Kentucky VA Mortgage loans requirements :

- VA does not have a minimum credit score requirement, but if the credit score is below 620 few lenders will do the loan, but I am set up with several Kentucky VA lenders where I have closed them down to a 560 credit score, but the borrower had good compensating factors such as large down payment, low dti ratios, good job history and good residual income with no previous bankruptcies or foreclosures.

- I would suggest if your credit scores are below 580, I would suggest on working on getting the scores up before you applied for a VA mortgage loan.

- A lot of lenders will do a rapid rescore which in some cases can increase your credit scores in as little as 7-10 working days.

- The federal Department of Veterans Affairs (VA) guarantees loans for current and former members of the military and their families. VA loans provide very favorable terms to eligible borrowers and have limited qualifying requirements. You can get a VA loan with no down payment so long as the home isn’t worth more than you pay for it, and there’s no minimum credit score to qualify. You also don’t have to pay for mortgage insurance, although you do have to pay an up-front funding fee of between .5% and 3.3% of the loan amount unless you fall within an exception for disabled vets or military widows or widowers.

- Kentucky USDA Mortgage credit score requirements:

- According to their guidelines, USDA will go down to a 580 credit score, but most lenders will want a 640 credit score. USDA uses an online system to underwrite the risk of the loan, and scores under 640 are very difficult to get approved.

- Validating the Credit Score. Two or more eligible tradelines are necessary to validate an applicant’s credit report score. Eligible tradelines consist of credit accounts (revolving, installment etc.) with at least 12 months of repayment history reported on the credit report. At least one applicant whose income or assets are used for qualification must have a valid credit report score

- The Rural Housing Service (RHS) operates under the federal Department of Agriculture to guarantee loans for rural home-buyers with limited income who can’t obtain conventional financing. The upside is that Kentucky USDA loans require no down payment. The downside is that they charge a steep up-front fee of 1% of the loan amount (which can be paid off over the entire loan term) and an annual fee of 0.35%.

- Kentucky Fannie Mae and Freddie Mac Conventional Credit Score Requirements

These are considered “conventional loans’ that can be often be obtained with a 3% to 5% down payment. Of course, there are higher standards for conventional home financing. The most common minimum credit score requirement to get approved today is a 620 FICO. This type of score is typical for people that have high credit card balances or a few delinquent payments in their past. The general consensus on Freddie Mac and Fannie Mae loans in Kentucky is that a 620 score is the entry-point to qualify, but you will need thorough documentation of income with credit scores in the 620 to 640 range. You will have a better shot to be approved for a mortgage-backed by Fannie or Freddie with a 680-credit score and less strenuous underwriting.

- Competitive Mortgage Rates and Fees

- Monthly Mortgage Insurance Is Not Always Required

- Ideal for First Time Home Buyers with Good Credit

As far as previous Bankruptcies and foreclosures:

Kentucky FHA Mortgage Loans currently requires 3 years removal from a foreclosure or short sale and 2 years on a bankruptcy with good re-established credit.

Kentucky Fannie Mae Mortgage Loans currently requires 4 years removal from bankruptcy, and 7 years on a foreclosure.

Kentucky VA Mortgage Loans currently requires 2 years of removal from bankruptcy or foreclosure with good re established credit.

Kentucky USDA loans require 3 years of removal from bankruptcy and foreclosure with good reestablished credit.

The most common minimum credit score requirement to get approved today is a 620 FICOAssets

What the mortgage underwriter is looking for here is how much can you put down and secondly, how much will you have in reserves after the loan is made to help offset any financial emergencies in the future.

Do you have enough assets to put the money forth to qualify for the down payment that the particular program asks for? The only 100% financing or no money down loans still available in Kentucky for home buyers are available through USDA, VA, and KHC or Kentucky Housing Loans. Most other home buyers that don’t qualify for the no money down home loans mentioned above, will turn to the FHA program. FHA loans currently require a 3.5% down payment.

Kentucky Home buyers that have access to putting down at least 5% or more, will usually turn to Fannie Mae or Freddie Mac mortgage programs so they can get better pricing when it comes to mortgage insurance.

These assets need to be validated through bank accounts, 401k or retirements account and sometimes gifts from relatives or employer… Can you borrow the down payment? Sometimes. Generally, if you’re borrowing a secured loan against a secured asset you can use that. But rarely can cash be used as an asset. FHA will allow for gifts from relatives for down payments with little as 3.5% down but Fannie Mae will require a 20% down payment when a gift is being used for the down payment on the home.

The down payment scenarios listed above are for Kentucky Primary Residences only. There are stricter down payment requirements for investment homes made in Kentucky.

| Conventional | You want to make a 3% down payment and have a credit score of at least 620 |

| FHA | You have a credit score of 580 and can make a 3.5% down payment You have a credit score of 500 and can make a 10% down payment |

| VA | You’re an eligible active-duty service member, veteran or eligible spouse You don’t have money for a down payment You don’t want to pay mortgage insurance You want the flexibility of a program with no minimum credit score |

| USDA | You want to buy a home in a rural area with no down payment You earn a low-to-moderate income |

THINGS YOU SHOULD KNOW

A quick guide to loan types

- 30-year fixed-rate loans allow you to pay a loan over a 30-year payment schedule

- 15-year fixed-rate loans allow you to pay a loan off in 15 years

- Conventional loans follow guidelines set by government-sponsored enterprises Fannie Mae and Freddie Mac.

- FHA loans are insured by the Federal Housing Administration.

- VA loans are guaranteed by the U.S. Department of Veterans Affairs.

- USDA loans are backed by the U.S. Department of Agriculture to finance homes in USDA-eligible rural area

Joel Lobb

Mortgage Loan OfficerIndividual NMLS ID #57916

American Mortgage Solutions, Inc.10602 Timberwood Circle Louisville, KY 40223Company NMLS ID #1364

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

Text/call 502-905-3708 kentuckyloan@gmail.com

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant’s eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant Equal Opportunity Lender. NMLS#57916 http://www.nmlsconsumeraccess.org/— Some products and services may not be available in all states. Credit and collateral are subject to approval. Terms and conditions apply. This is not a commitment to lend. Programs, rates, terms and conditions are subject to change without notice. The content in this marketing advertisement has not been approved, reviewed, sponsored or endorsed by any department or government agency. Rates are subject to change and are subject to borrower(s) qualification.