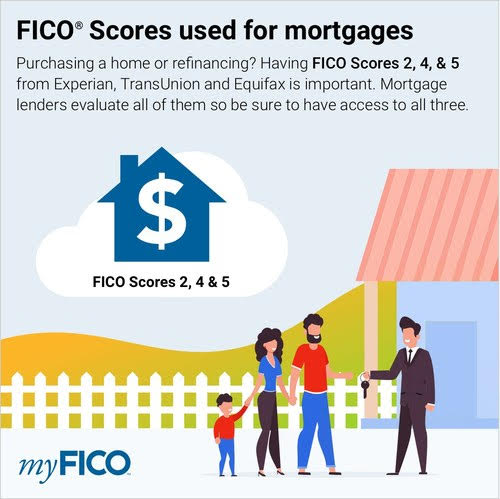

If you’re planning to apply for a mortgage, be aware that the credit score you see on your application might differ slightly from the one you’re used to.

Banks use a slightly different credit score model when evaluating mortgage applicants. Below, we go over what you need to know about credit scores you’re looking to buy a home.

The scoring model used in mortgage applications

While the FICO® 8 model is the most widely used scoring model for general lending decisions, banks use the following FICO scores when you apply for a mortgage:

FICO® Score 2 (Experian)

FICO® Score 5 (Equifax)

FICO® Score 4 (TransUnion)

As you can see, each of the three main credit bureaus (Equifax, Experian and TransUnion) use a slightly different version of the industry-specific FICO Score. That’s because FICO tweaks and tailors its scoring model to best predict the creditworthiness for different industries and bureaus. You’re still evaluated on the same core factors (payment history, credit use, credit mix and age of your accounts), but the categories are weighed a little bit differently.

The FICO 8 model is known for being more critical of high balances on revolving credit lines. Since revolving credit is less of a factor when it comes to mortgages, the FICO 2, 4 and 5 models, which put less emphasis on credit utilization, have proven to be reliable when evaluating good candidates for a mortgage.

Mortgage lenders pull all three reports,from all three bureaus, but they only use one when making their final decision.

“A bank will use all three bureaus,”— “It’s called a tri-merge.”

If all three of your scores are the same, then their choice is simple. But what if your scores are different?

If two of the three scores are the same, lenders use that one, regardless of whether it’s higher or lower than the other one.

And if you are applying for a mortgage with another person, such as your spouse or partner, each applicant’s FICO 2, 4 and 5 scores are pulled. The bank identifies the median score for both parties, then uses the lowest of the final two. For example if you have a 598, 625, 604 on each of the main three reporting agencies, then your qualifying fico score would be 604.

FICO Scores used for mortgages Which Credit Score is used for a Kentucky Mortgage Loan Approval?

Mortgage Loan Officer

Text/call: 502-905-3708

email: kentuckyloan@gmail.com